Traditional banking is dying out. From wherever you are, you can do business without a slight worry yet efficiently getting served. From agent banking, to the use of USSD, everyone is included in today’s banking activity; and with online banking sinking deeper in the hearts of Ugandan bankers, the volume of transactions on digital channels keeps on increasing – something that is driving the growth of banking institutions.

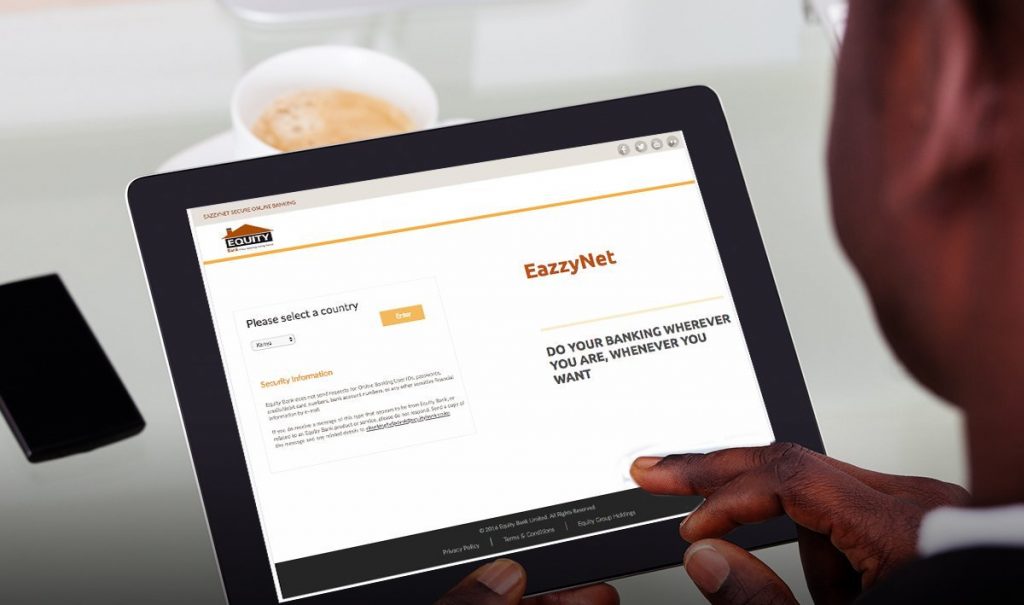

Among the best online banking services is Equity Bank’s EazzyNet, a banking platform for individuals over the Internet, which you can access from your computer, laptop, tablet, or smartphone. When you visit the EazzyNet portal, you are requires to select your country, after which you will be redirected to the login page.

It is part of Equity Bank’s Eazzy Banking suite.

What can you do with EazzyNet Online banking?

You can do all the banking, open up an account, buy bank shares, pay for utilities, send money, do electronic commerce, and even apply for a loan, all at the comfort of your location on the internet.

EazzyNet online banking enables Equity bank users to access their account information, effect payments for bills such as Umeme power bill, Water and Pay TV services. They can also transfer funds to another account within Equity bank for free, make payments to beneficiaries of other banks in Uganda, buy airtime, view account mini statement balance, the client is also able to extract free account statements for the last three (3) months.

In summary you can;

- Effect transfers in and out of the country

- Pay Umeme and NWSC bills

- Check balance, Print statements for the last six months

- Airtime purchase

- MTN mobile wallet – you can transfer funds from your account to your mobile money account.

- Make bank transfers from your Equity account to another Equity account – free of charge.

Read About: How to register and use Stanbic Uganda internet banking service

How to register for EazzyNet Online banking

Registration for EazzyNet online banking is free. To register, you must have an active Equity bank account. If you already have one, you have to visit any nearby Equity Bank branch with your valid identification and fill a form. They will then give you a user ID and password that you can use to login to their internet banking portal.

You can as well visit this link to register online; requiring you to feed in your account number, active mobile number, and active email address. A One-time password (OTP) will be sent to the mobile number via SMS which you will enter to confirm your registration. After a successful registration, you should also receive a User ID which you will use to login to the portal.

Internet banking security tips

Whereas internet banking will save you long queues in the bank, you ought to know that there are other people who might want a piece of your money — for free.

- For starters, make sure there’s no one physically eavesdropping you unless they are trusted people while you enter you login details. Whenever using the system, you are to receive an OTP via SMS or email, it is up to you to ensure that it is only you who is accessing your account and no one else.

- Use strong passwords. Most likely the bank will give you a default strong password you can use to access your account, but am sure they have an option of letting you choose your own password. A secure password is one that has alphanumeric characters and special symbols. “12345678” or “davidokwii” is not a secure password. “d@ve1sK00l” is a secure password.

- Do not use a public computer like the one at internet cafe, even a desktop at work or a borrowed laptop unless you really have to.

- Always look out for the padlock symbol in the website URL. Symbols like an unbroken lock or key and a URL that begins with https:// mean that no one but you and the merchant can view your payment information.

- This can seem trivial, but remember to logout from your account once you are done. If you don’t, it’s like walking out of your own house and leaving it wide open for anyone to freely enter.