For the most part of it, a good majority of bank users may not exactly be aware that asides using Automated Teller Machines (ATMs) to make quick cash withdrawal without having to go into banking halls and spending tens of minutes (perhaps hours) on the queues, ATMs can also be used to deposit money into a bank account.

You might question the idea behind depositing cash via ATMs, particularly in this age of electronically transferring currencies over-the-air using our mobile phones in seconds. But what happens when all you have is cash? Or it’s a weekend when banks are closed and you need to send cash to a supplier? Nothing is exactly useless; you just don’t need it (yet).

Before delving into how it works, as well as other aspects of ATM deposits, you should know that:

- You cannot deposit cash with an ATM designed to dispense money i.e Deposit-enabled ATM and withdrawal-enabled ATM are different.

- The ATM you are using must be owned and operated by the bank hosting the recipient/beneficiary’s account. In simpler words, you cannot deposit cash into an account in Bank A using Bank B’s ATM.

When you need to deposit cash or checks, your easiest option might be to use a deposit-enabled ATM.

When you need to deposit cash, especially over the weekend or outside bank opening hours, your easiest option may be to use a deposit-enabled ATM. There’s no need to wait until you can visit a banking hall. Some people don’t know that depositing funds at an ATM is possible, while others are uncomfortable with the idea or they just don’t know how to do it.

How ATM Deposit works

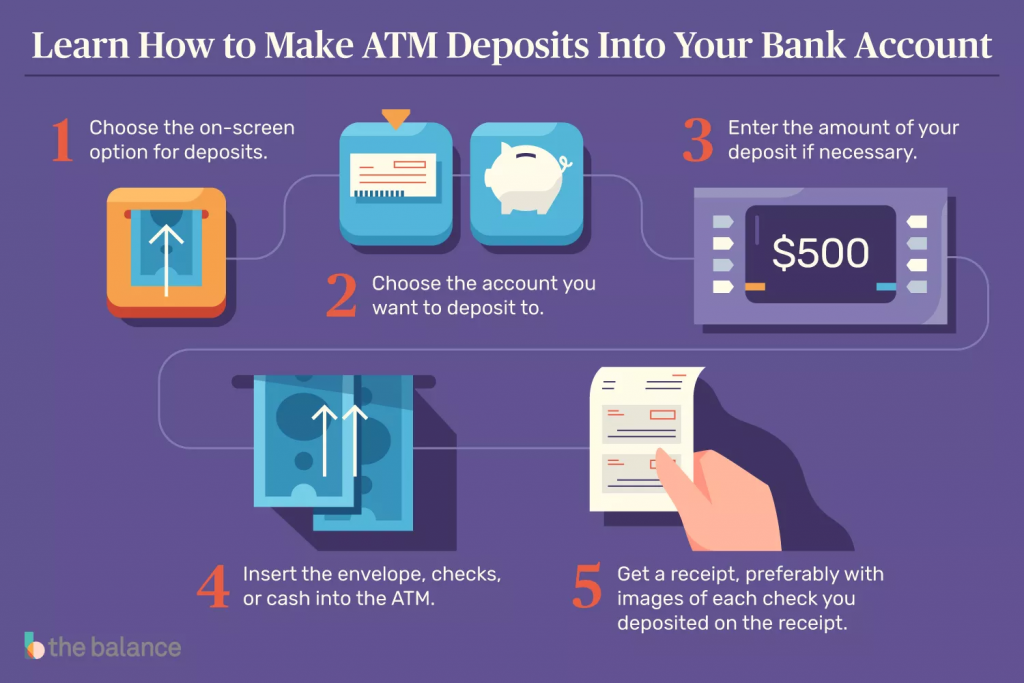

While the ATM depositing procedure varies bank-by-bank as well as the type/model of the ATM, the general idea revolves around the infographic below:

1. First thing you’d want to do is to confirm that the ATM is a deposit-enabled machine. You’d also want to confirm what — depending on how you’re depositing cash– the ATM accepts: cheque, cash, or both.

2. Insert your debit card into the ATM and subsequently enter your PIN for authentication

3. You’d be asked to specify which account you want to deposit funds as well as the amount you want to deposit.

4. Step (3) above might be unnecessary though if you’re depositing a check as some ATMs can automatically detect the amount you’re depositing by reading figures from the check.

5. Next step is to insert cash notes or check into the machine. While some ATMs would allow users insert multiple cash notes, you might be instructed to insert cash one at a time. Some ATM models even require the cash to be put in an envelope while some can only take in a specified maximum number of notes (say 20 to 50) at once.

Pro Tip: Be sure of the cash collection method of the ATM you intend to use in making deposits. You don’t want to go unprepared.

When you’re done inserting cash to the machine, review the details of the transaction and confirm if everything checks out.

You’d be issued a receipt after which you can end the session and eject your debit card.

How Deposits are Processed

Downsides & Errors

To err is human…and machine too, I guess. ATM deposits could be convenient and time-saving but the truth is: no man-made machine is 100% fault-free. Just as using ATMs for withdrawals comes with its fault (deducting money from your card but withholding cash, for instance), the same thing applies to ATM deposits. So before hopping on the next available deposit-enabled ATM, always bear in mind that things could go south.

Some common errors that could occur include:

- No records of deposited cash/check

- Money vanishes after going in the ATM slot

- Rejection: some machines may reject checks, perhaps because they are unreadable or for some other reasons.

- Counterproductiveness: the process may be time-consuming, particularly if you don’t possess the know-how.

- In the case of any errors, however, they can be easily resolved within hours or days.

Tips

To avoid cash rejection or any error at all, be sure of the currency the ATM accepts, as well as supported denominations.

Do not attempt to deposit counterfeit currencies. You’d get into trouble — check out this Quora thread to learn what happens when you deposit counterfeit money in an ATM.

After every successful deposit, ensure you print and keep the receipt of the transaction.

For security purposes, avoid depositing huge sum of money via ATM. Deposit huge amounts over the counter during banking hours instead.

While cash and check deposits are often posted on the same day and available in your account for withdrawal, it may sometimes take up to 1-2 days depending on amount deposited among other factors.

Ever tried ATM deposits? How was the experience? Did you encounter any error or glitches?