2025 Update: If you’re looking for a quick, accessible loan in Uganda, Airtel Uganda’s Quick Loan service is a game-changer. As one of the country’s leading telecoms, Airtel has evolved well beyond calls and data—now partnering with fintechs like YABX and Housing Finance Bank to bring digital financial services to millions. This move mirrors a wider trend across Uganda’s telecom sector, as companies like Airtel and MTN diversify from traditional services into mobile money and micro-lending. Compare more financial products, fees, and services on SenteGuide.com.

With Uganda’s economy rebounding post-pandemic, demand for instant, no-paperwork loans is at an all-time high. Airtel Quick Loan is designed for exactly that—giving you a fast, simple way to access emergency cash straight from your Airtel Money wallet. Here’s everything you need to know in 2025.

How to Sign Up for Airtel Quick Loan (2025)

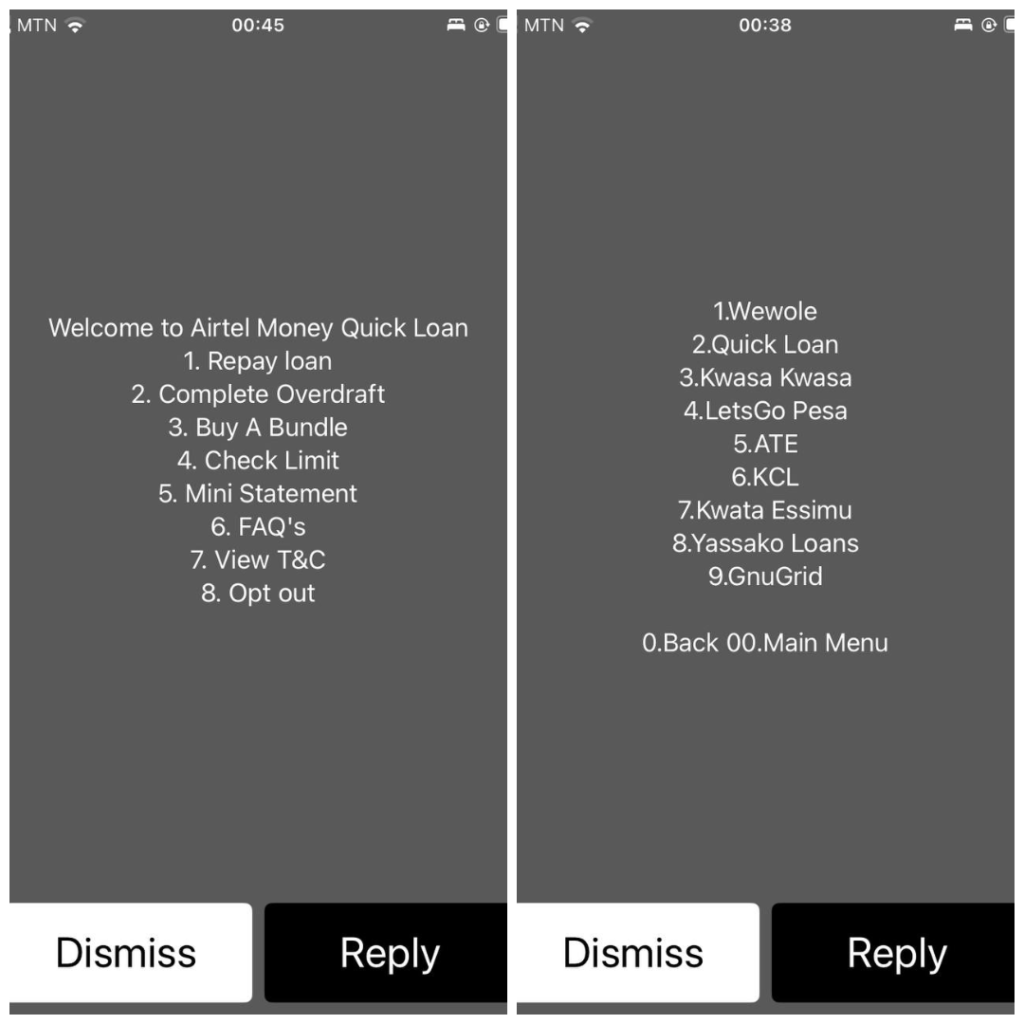

- Dial *185*8# on your Airtel line.

- Select Option 2 for “Quick Loan” and follow the prompts.

- If eligible, you’ll get a welcome SMS and access to the loan menu.

Eligibility is based on your Airtel Money usage and transaction history. Not all numbers qualify, so keep using Airtel Money for the best chance.

Fees, Interest, and Repayment (2025)

| Amount Borrowed | Application Fee | Interest | Repayment Period |

|---|---|---|---|

| UGX 50,000 | UGX 1,000 | UGX 7,500 | 30 days |

Repayment is easy: Dial *185*7*10#, choose “Repay Loan,” enter the amount, and follow the prompts. Early repayment reduces your interest owed.

How to Check Your Loan Limit

- Dial *185*7*10# and select “Check Limit” (Option 4).

What’s the Difference with Airtel Wewole?

Unlike Airtel Wewole, which credits your mobile money account directly, Quick Loan only activates when you have insufficient funds during a transaction. Learn more about Wewole in our full guide.

2025 Comparison: Airtel Quick Loan vs. MTN MoKash

| Feature | Airtel Quick Loan | MTN MoKash |

|---|---|---|

| Loan Amount | Varies (e.g., UGX 50,000) | UGX 3,000–1,000,000 |

| Interest/Fees | UGX 1,000 app fee + UGX 7,500 interest (example) | 9% facility fee for 30 days |

| Repayment Period | 30 days | 30 days (+9% late fee if overdue) |

| How to Access | *185*7*10# | *165*5# |

| Unique Features | Loan only triggers on insufficient funds | Includes savings + loans, direct mobile money credit |

For more on MoKash, see our guides: 10 Things You Need to Know About MoKash and How to Access Savings and Loans via *165*5#.

Expert Tips & Local Insights

- Use your mobile money account regularly to boost your eligibility for both services.

- Repay early to save on interest (especially with MoKash’s 9% late fee).

- Compare fees, loan amounts, and features at SenteGuide.com before choosing.

- For more on mobile lending in Uganda, check out our Airtel Wewole explainer.

Mobile loans are transforming access to credit in Uganda. Whether you choose Airtel Quick Loan, MTN MoKash, or another provider, always read the terms and compare your options for the best deal. Got questions or your own experience to share? Drop a comment below or see more guides on Dignited.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.