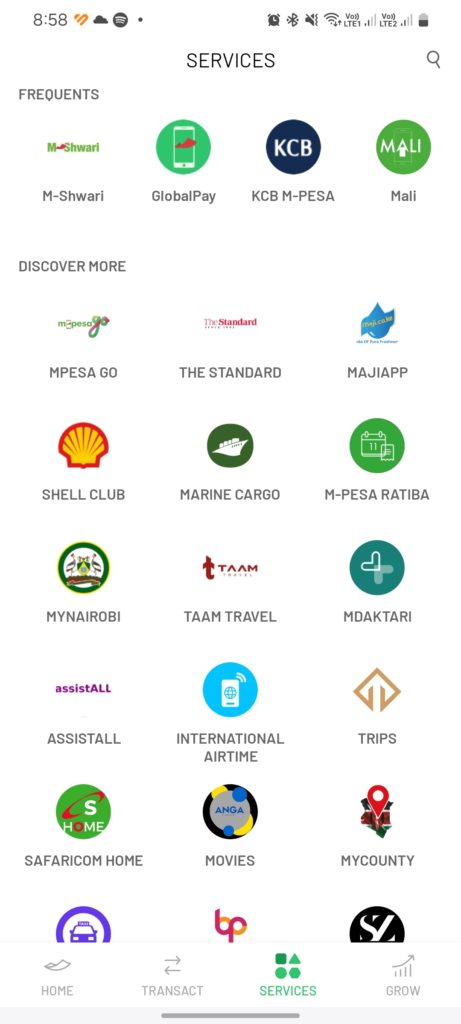

Kenya’s mobile money pioneer, M-PESA, isn’t just about sending and receiving money anymore. Safaricom has grand ambitions to transform M-PESA into a comprehensive financial hub, a place where Kenyans can manage all aspects of their finances.

The new standing orders service dubbed M-PESA Ratiba, along with a growing collection of mini-apps, signals a significant step toward this ‘Kenyan WeChat’ vision.

Related:

- Understanding M-PESA Paybill Standard Tariffs in Kenya: A Business Owner’s Guide

- Here Are the Updated M-PESA Transaction Charges for 2024

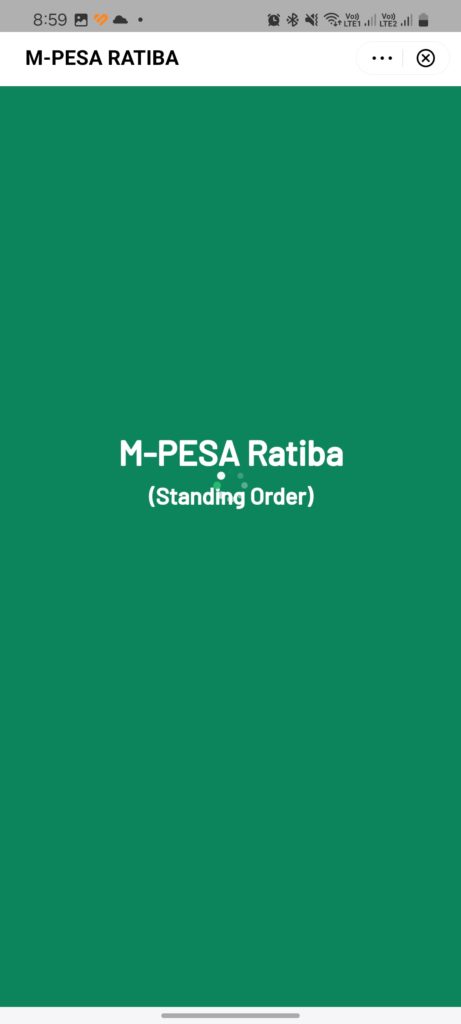

What is M-PESA Ratiba?

M-PESA Ratiba tackles the ever-present problem of managing recurring payments. With this service, Kenyans can choose from a range of transactions to automate – recurring money transfers, bill payments, Lipa na M-PESA purchases, and more.

This service has been rumoured for a while since last year and today, it is available to some M-PESA customers via the M-PESA super app. I tried to sign up but was unable to as I kept running into this page.

How does it work?

When it becomes available widely, I assume setting up a standing order for money transfers involves specifying the recipient’s name, defining the amount, and selecting the frequency of transfers.

This process can be fully automated, with funds deducted from the user’s account at the scheduled time.

Importantly, automatic deductions only occur when explicitly configured by the customer, ensuring full control over financial activities.

Related:

- M-PESA Standing Orders: Here’s Why This Is a Big Deal

- M-PESA Tightens Security: No More Transfers to Unregistered Accounts

The Road Ahead

Safaricom’s relentless push for financial inclusion continues with services like M-PESA Ratiba, M-PESA Global, and Globalpay. Saving options like KCB M-PESA and M-Shwari

The new Standing Order feature simplifies the lives of Kenyans by removing the burden of remembering and manually executing recurring payments. The arrival of M-PESA Ratiba is a powerful indicator of Safaricom’s determination to create a comprehensive financial ecosystem, accessible and convenient for all Kenyans.

While challenges exist, the journey towards the ‘Kenyan WeChat’ is one filled with exciting possibilities!