M-PESA is massive in Kenya and for many people, is the primary mode of payment and transaction. However, the versatility of this platform seems to be a little limited when it comes to international money transfers and payments.

Of course, Safaricom has tried to integrate services like PayPal and MoneyGram but for the most part, the platform only reigns supreme in Kenya. Not too long ago, we saw reports that Safaricom was looking to expand the reach of M-PESA by dipping its toes into the whole Virtual Visa cards space.

Well, today, this service is live and the millions of M-PESA customers can now create virtual VISA Cards and use them to perform payments online. In this post, we quickly guide you through the process of setting this up.

How to Create M-PESA Virtual Visa Card

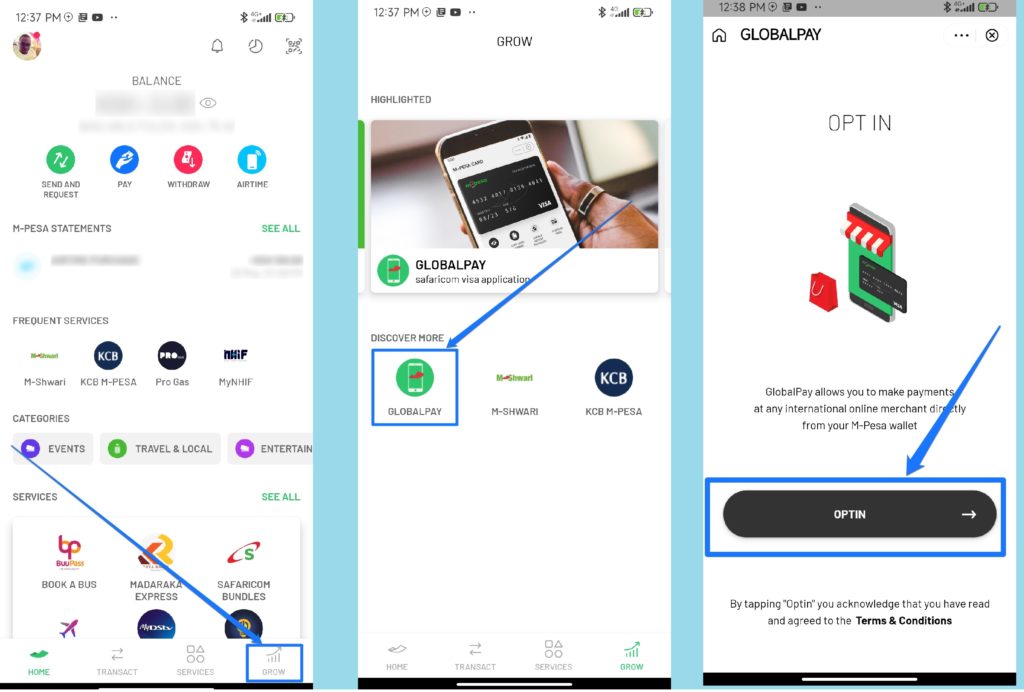

To get yourself a virtual GlobalPay card, follow these simple steps.

- Install M-PESA app from your Play Store or App Store.

- Open the app and go to the “Grow” tab

- Click “GlobalPay” and Opt-in.

- You will receive an SMS from ‘Globalpay’ notifying you about the successful opt-in.

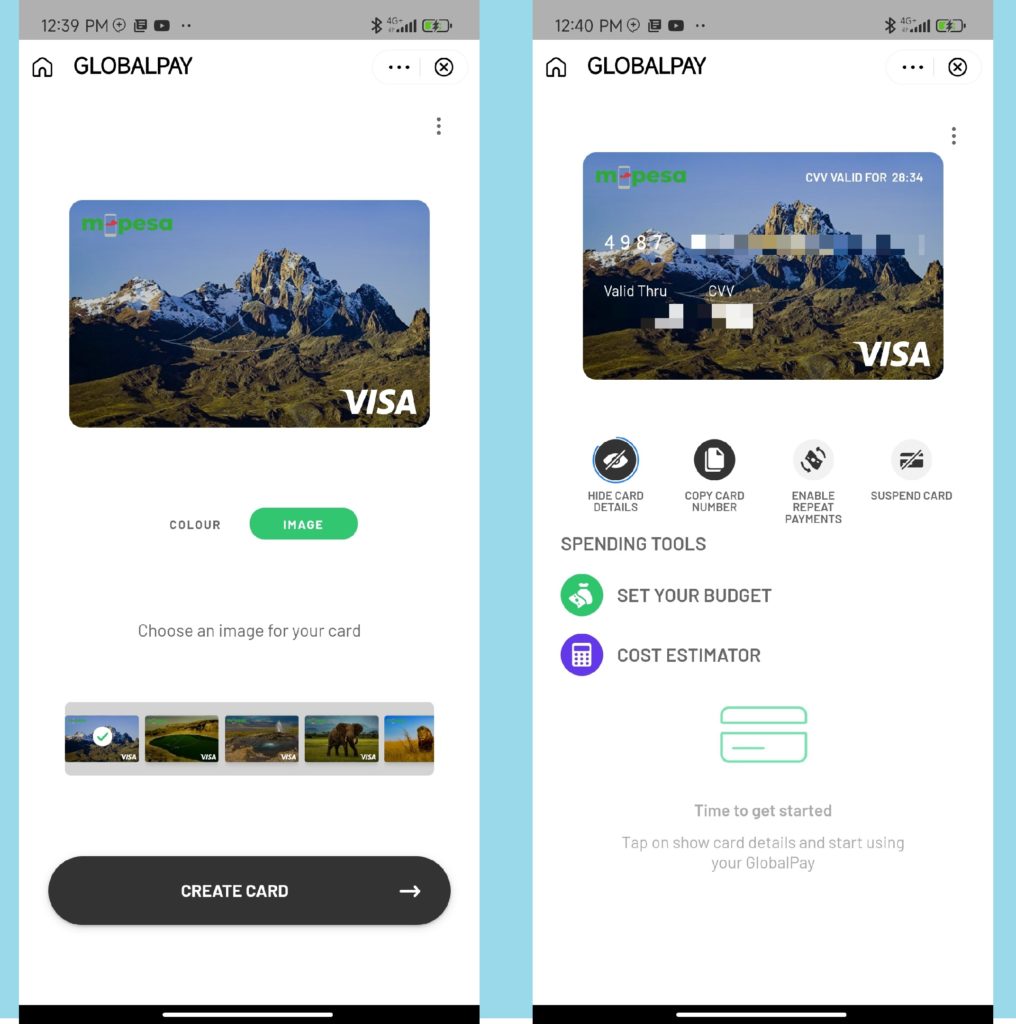

- You will then need to customize your card color and image

- After customizing how it looks, you get to create the Card.

- You will receive an SMS with your card number and its expiry date. Keep these safe.

- From the app you will be able to see card number details and the dynamic CVV.

Should you not want to use the app, you can access this service via USSD when you dial *344# and access Lipa na M-Pesa, Global Pay option.

These M-PESA Virtual Visa Cards are an extension of your M-PESA account and are subject to M-PESA’s limitations in terms of amount transactions, balance limits, and so on. For instance, you can only transact a maximum of Ksh 150,000 and the maximum amount you can transfer in a day is capped at Ksh 300,000, just like M-PESA.

Related:

- MTN Uganda launches MoMocard, a Mastercard-powered virtual card for shopping and making payments

- How to get Airtel Uganda Mastercard Virtual Debit Card for online shopping

- Differences Between MTN MoMo Card and Airtel Virtual MasterCard

Across the border, Ugandans have been enjoying virtual cards on their major carriers, MTN and Airtel for years now in form of the MoMo Card and Airtel’s Virtual Mastercard. It is refreshing to see Kenya joining this league.

Before this, Kenyans had to resort to using apps like Eversend, Chipper Cash, and Flutterwave to get virtual Mastercard and Visa cards to pay for their subscriptions or pay for goods and services online. This first-party solution is a welcome addition and should make OTT services like Netflix and others a lot more attainable.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.