Whoever coined the term, old dogs can’t learn new tricks hadn’t met Visa yet. Kenya, world-renown for MPesa’s advanced mobile payment system which even Facebook’s Mark Zuckerberg marveled at is set to scoot-over and welcome yet another entrant. Visa Inc. operates VisaNet, one of the most world’s most advanced electronic money transfer services. Most banks offer Visa-enabled credit cards which streamlines the process of transferring funds from one bank to another.

While much of the world operates on a credit card-based payment system, Africa is largely unbanked. This means Visa could not make any headway in Kenya the old-fashioned way. Africa’s quiet revolution is a mobile-based system of payment aka mobile money. And Kenya with MPesa is clearly the leader. According to Standard Media, Kenyan mobile money transactions reached KES. 3 billion ($30 million) a day in April 2016.

Visa looks to tap into this payment system with mVisa. Visa has partnered with four Kenyan banks so far: KCB (largest bank in Kenya serving over 7 million subscribers), Cooperative Bank of Kenya, Family Bank and NIC Bank.

Visa is planning to roll out mVisa in Uganda, Tanzania and Rwanda within two months. A deal with their first Nigerian Bank is also in the offing, expected by end of year 2016. According to Andrew Torre, Visa’s head for sub-Saharan Africa, the company is in talks with South Africa to introduce mVisa as well.

Quotable: “Family Bank was the first bank in Africa to roll out this revolutionary service, putting us at the center of innovative financial solutions. Customers will be able to make payments for goods and services – easily and conveniently. The new service will also enable them to send and receive funds from other Visa account holders worldwide as well as withdraw and deposit cash to and from their account at mVisa agent outlets,” David Thuku, the Chief Executive Officer of Family Bank.

“mVisa is an innovative service that merges the everyday mobile phone to a payment solutions plan that is easy to use, effective and at zero cost to our customers. Through mVisa, KCB Bank is steadily realizing its dream for financial inclusion as we embrace innovation, at its best, to deliver superior services in the best way possible to our customers,” KCB Bank Kenya Retail Director, Anastacia Kimtai ~KassFM

mVisa’s interoperability

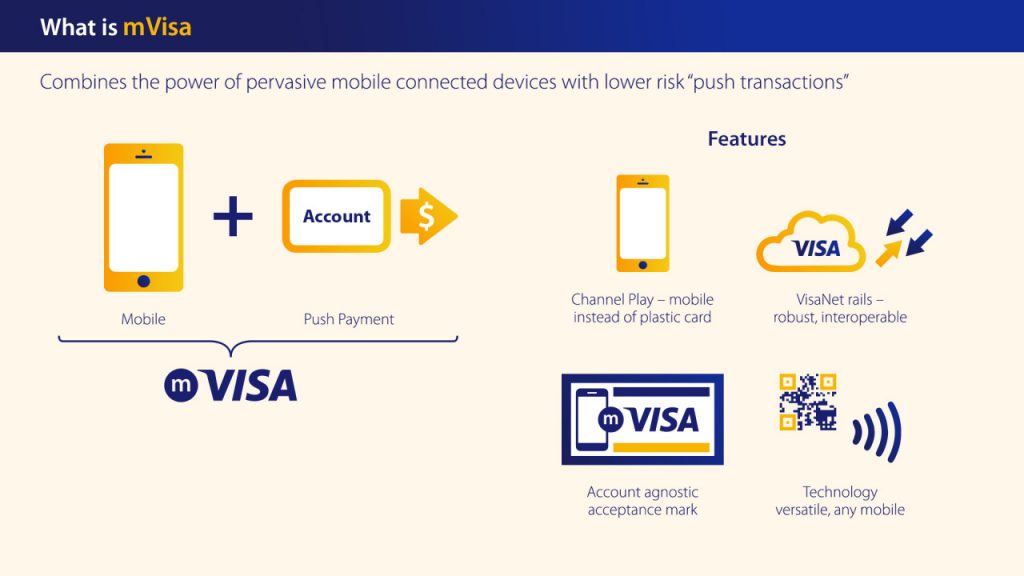

The biggest difference between mVisa and other mobile money platforms is interoperability. What this means that mVisa is not limited to whichever platform a user is currently subscribed to. An mVisa user can transfer funds to Safaricom or Airtel seamlessly. This feature has hitherto been lacking in the mobile money platforms. mVisa also works on both feature phones and smartphones.

On feature phones as with smartphones, an mVisa user has full access to their bank accounts. They can directly tap into their bank acount and transfer money to merchants (business) or another person. The transaction is processed by the VisaNet network thus you don’t need to be of the same bank or telco. For the customer to initiate a transaction, they enter the merchant’s number. Alternatively, they can scan the merchant’s QR code if they use smartphone devices.

How mVisa works

According to KassFM, the following bullet points break down the process of activating and using mVisa services:

- Consumers will be able to access mVisa via their bank’s mobile application on their smart phone or via USSD on their feature phone.

- Once activated, mVisa enables consumers to send money to anyone using the service.

- Aside from P2P, consumers pay for purchases in any retailer including supermarkets, fuel stations and ecommerce by simply transferring funds from their account to the merchant’s account via a QR or USSD code.

- mVisa transactions are processed via Visa’s global network, VisaNet, applying the scale, security and reliability of Visa to mobile payments in emerging markets. The service is designed to enable consumers to access funds in their existing bank accounts more easily in order to make everyday purchases and pay for utility bills and government services, securely and conveniently.

- Merchants and billers benefit by offering consumers a more convenient and secure way to pay, and are instantly notified via SMS text message when a payment has been received. The payments are received directly into their bank accounts allowing them to better manage their business.

Benefits of using mVisa

Unlike the traditional mobile money system, mVisa has the advantage that it taps into a global Visa network. Visa has the option of awarding refunds for money sent in error. The platform will bridge the gap between traditional banks and mobile money subscribers. Money is paid directly to a bank account and withdrawn from an ATM or an agent. We are not yet sure whether an mVisa user can send money across borders. All in all, mVisa is gearing up to be a game changer.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.