The banking sector tends to follow a particular script. They keep your money safe and charge you service charges when you want to borrow money or make a transaction. The business model has been exorbitantly profitable, making banks lazy and unable to innovate to give customers a better user experience. Stanbic Bank Uganda looks to be abandoning the script(at least so far). Their fintech service FlexiPay is a force to reckon with, giving customers a better user experience outside the banking walls.

Let’s look at what Stanbic FlexiPay is in this guide. How to register as a customer, merchant, the transaction cost, and the perks that come when you use the FlexiPay service. Let’s get started with it, shall we?

What is Stanbic Bank’s FlexiPay?

Stanbic Bank Uganda has created FlexiPay, a financial technology inclusion service that allows users without bank accounts to create wallets, send and receive money, deposit money into their wallets using mobile money, and bank accounts using their phone numbers. Customers can register an account either through a mobile app or by using the USSD shortcode *291#. Business owners, on the other hand, can register their businesses and get a merchant code to receive payments from customers.

How to Register and Use FlexiPay as a Customer

Here is how you can register a FlexiPay account through the app and shortcode *291#.

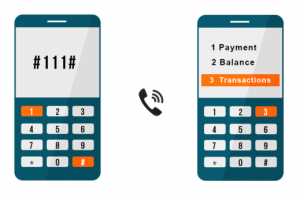

Using USSD Shortcode *291#

- Step One: Dial *291# to access Flexipay Wallet

- Step Two: Select the first option to “Register a new FlexiPay wallet” and enter your details (surname, first name, another name, National ID, National card number, Date of birth, gender, email, occupation, and email).

- Step Three: You will then confirm self-registration with a 5-digit one-time pin.

- Step Four: Dial *291# again to change the one-time pin and you are good to go.

Using the FlexiPay Mobile App

- Step One: Download and install the Flexipay Wallet App from Google Play Store or Apple’s store for iOS devices.

- Step Two: Launch the app and click on the “Get Started” button. Enter your phone number to register.

- Step Three: Scan your national ID or manually enter the details to verify your identity.

- Step Four: Confirm personal details like alternative contact, email address, and occupation.

- Step Five: You will receive a 5-digit one-time pin on the registered number to verify the phone number registration. Input the one-time pin and change it to a preferred 5-digit pin.

- Step Six: Login again with your new pin to be able to use the FlexiPay mobile app.

Using the FlexiPay is straightforward, dial the shortcode *291# or open the mobile app to pay merchants, buy airtime, deposit or withdraw cash, and more.

You can deposit on your Flexipay wallet using your mobile money or Airtel money, Stanbic Bank Agent as well as your Stanbic Bank account if you have a bank account with Stanbic Bank Uganda.

READ ALSO: How to Register and Use Stanbic Uganda Internet Banking Service?

How Do I Register For FlexiPay As A Merchant?

All you need to become a merchant is your valid national ID and a Stanbic Bank account. You will then visit any nearby bank branch to set up your merchant account and get a code that can be displayed at your establishment to start accepting payments. There are some perks that come when you own the merchant account, like free collections and liquidation.

List of Free Services When You Use FlexiPay

- Deposit cash to your FlexiPay wallet.

- Send money to other FlexiPay wallets or Stanbic Bank accounts.

- Sending money to partner wallets as a merchant.

- Merchant Liquidation.

- Send money to other bank accounts.

- Merchant collections.

- Pay merchants.

Stanbic Bank’s FlexiPay Transaction Cost

Stanbic Bank charges an affordable fee when it comes to a few services. Here is the list and cost of the service charges.

| Transaction Range (UGX) | Withdraw Cash at the ATM | Pay Bills and School Fees | Send Money to Mobile Money Wallet | Withdraw Cash at Agent Point |

|---|---|---|---|---|

| 500-30,000 | UGX 12,000 | UGX 100 | UGX 830 | UGX 750 |

| 30,001 - 125,000 | UGX 12,000 | UGX 400 | UGX 940 | UGX 750 |

| 125,001 - 250,000 | UGX 12,000 | UGX 700 | UGX 1,880 | UGX 1,000 |

| 250,001 -500,000 | UGX 12,000 | UGX 1,000 | UGX 2,310 | UGX 1,250 |

| 500,001 - 1,000,000 | UGX 12,000 | UGX 2,500 | UGX 2,310 | UGX 1,750 |

| 1,000,001-2,000,000 | UGX 12,000 | UGX 2,500 | UGX 3,325 | UGX 2,500 |

| 2,000,001-4,000,000 | UGX 12,000 | UGX 2,500 | UGX 2,500 | UGX 4,500 |

| 4, 000,001-7,000,000 | UGX 12,000 | UGX 2,500 | UGX 4,975 | UGX 4,500 |

Have you ever used the FlexiPay service from Stanbic Bank? Share with us in the comment section your experience.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.