Just like any other digital (Payment) wallet, the Firstmonie wallet is FirstBank’s online digital platform that allows its customers to perform seamless, and quick transactions using their mobile numbers from anywhere, and at any time. The wallet gives you access to every feature a regular bank account/app will give you, and it takes it a step further with its ease of setup/use – all you need to use the Firstmonie wallet is your registered mobile number. In this article, we will show you how to create a Firstmonie wallet, its requirements, its benefits, and more.

How to Create a Firstmonie Wallet:

Before you get started, here are a few requirements you will need to create your Wallet:

- Mobile Phone: You can register using any kind of mobile device

- Active Mobile Number

- Airtime for USSD registration: Airtime as low as N4 is requested for session cost on USSD registration.

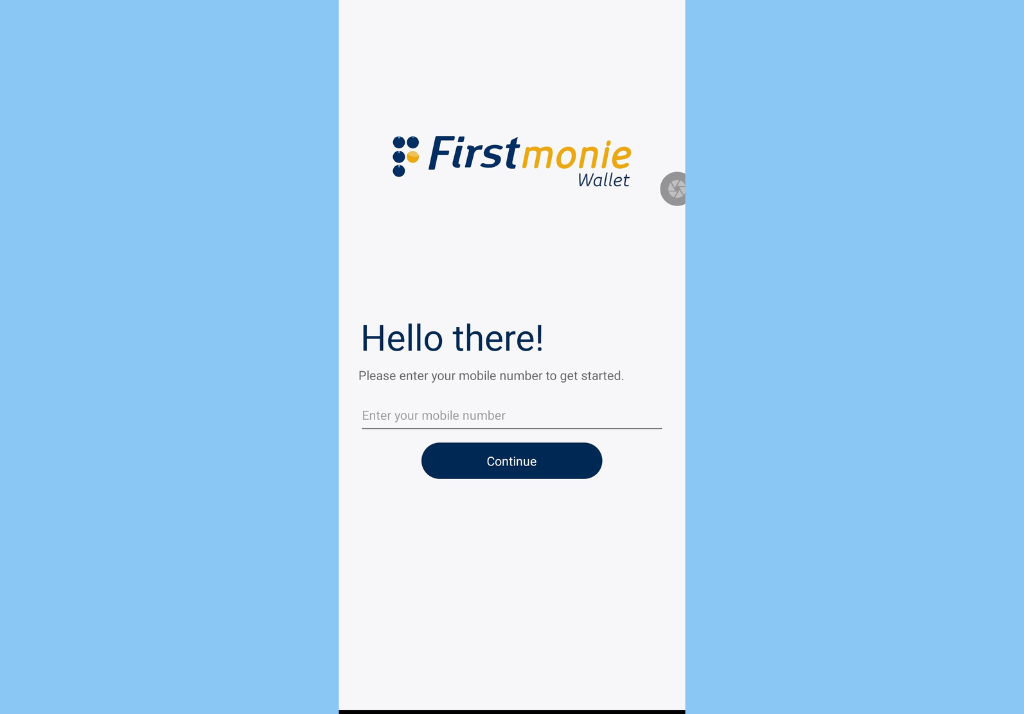

How to sign up for your Wallet (Mobile App)

- First, download the app from your store (iOS or Android)

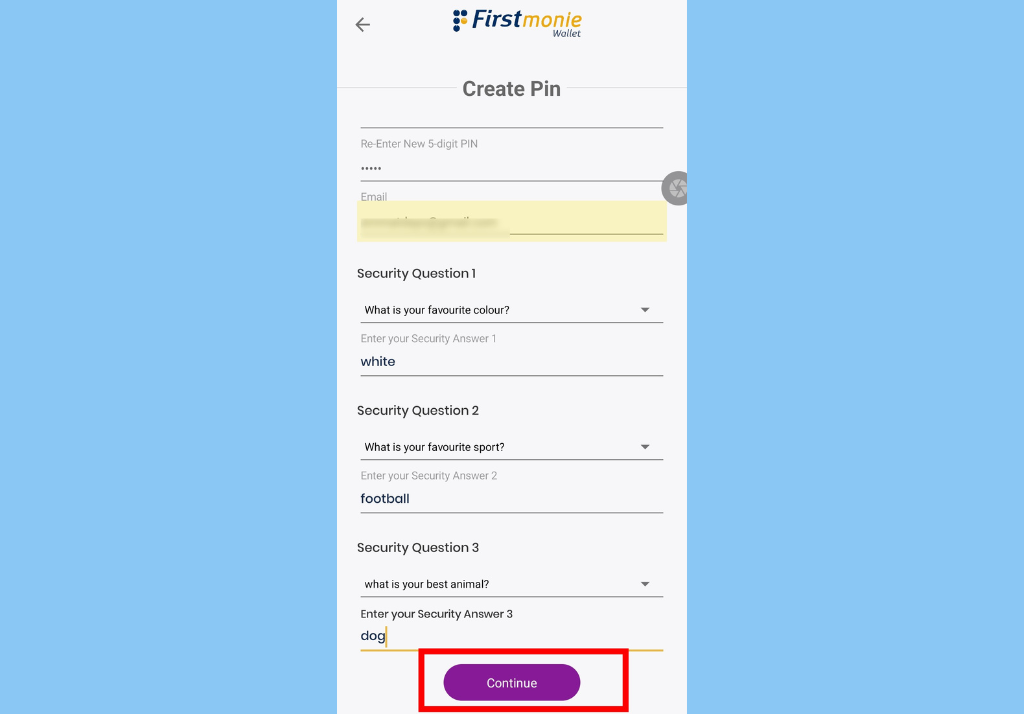

- Enter your mobile number >> create a 5-digit pin and enter your Security questions and answers and hit continue.

- Enter the OTP sent to you and hit Create Account.

To sign up for your Wallet via the USSD string,

- Just dial *894*1#.

- Choose 1 to register without BVN and input the necessary information.

- Choose 2 to register with BVN and follow the prompt.

- Related: How to Become a Mobile Money Agent in Nigeria

- Related: How to Transfer Money From Safeboda Wallet to a Bank Account or Mobile Money

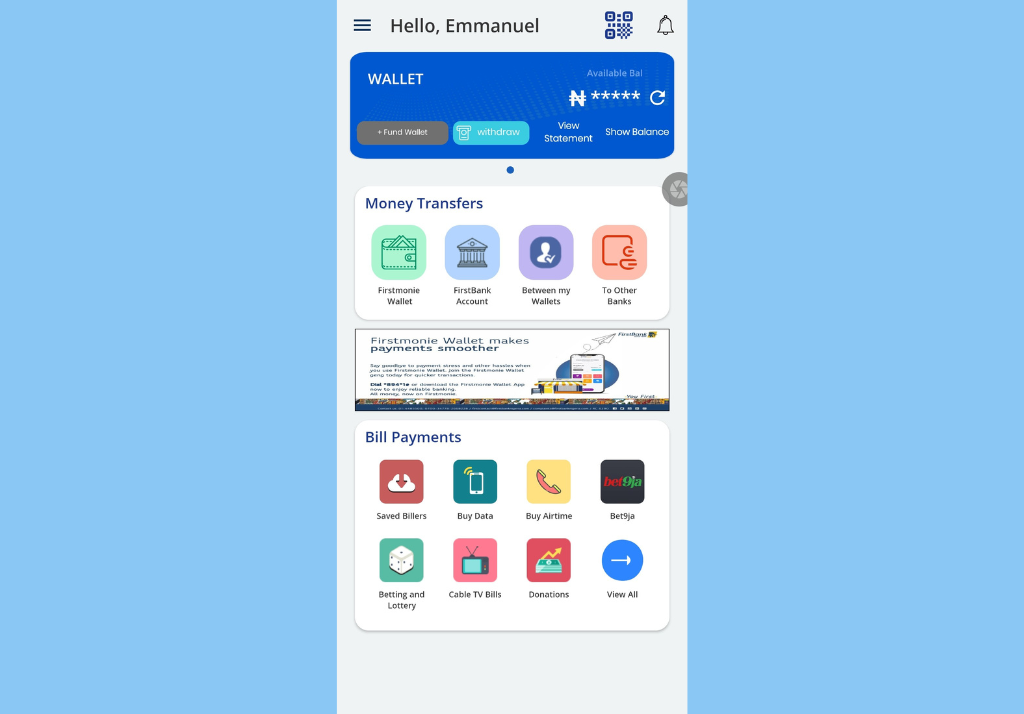

Firstmonie Wallet Features:

- inter-bank funds transfer

- Fund Wallet

- Airtime/Data Top-up

- Bill Payments

- Cash In & Cash Out

- Corporate Disbursements & Collections

- Access to Virtual debit Cards

- Agent Locator.

Wallet Tiers

There are three account classes for Firstmonie Wallet with unique specifications you should know about:

| Customer | Inflow Limit per day | Outflow limit | Wallet Capacity | Requirement |

|---|---|---|---|---|

| USSD/Mobile | ||||

| Firstmonie Classic | N50,000 | 50,000/50,000 | 300,000 | Name, Mobile Number, Date of Birth |

| Firstmonie Gold | N200,000 | 100,000/200,000 | 500,000 | BVN and Valid means of Identification (e.g. Voters’ Card) |

| Firstmonie Platinum | N5,000,000 | 100,000/1,000,000 | 10,000,000 | Comply with KYC requirements contained in CBN AML/CFT Regulation, 2009 |

Why Should You Use the Firstmonie Wallet?

With the Firstmonie wallet, you get access to different accounts via the wallet, you get access to your wallet with or without internet data (USSD), and you can carry out Instant transactions without your BVN.