If you are a registered taxpayer in Kenya but you did not earn any taxable income in a given year, you are required to file nil returns on iTax, the online platform of the Kenya Revenue Authority (KRA). Filing nil returns is a way of declaring that you have no taxable income to report for that year.

Filing nil returns is important because it helps you avoid penalties and maintain a good tax compliance record. In this blog post, we will guide you through the steps of filing nil returns on iTax, the KRA Portal.

What are Nil Returns?

Nil returns are tax returns that declare that you did not have any taxable income in a given year. For example, if you are a student, unemployed, or retired, you may not have any income to report to KRA. In that case, you need to file nil returns to confirm that you did not owe any taxes.

Why should you file nil returns?

Filing nil returns is important for several reasons:

- It helps you avoid penalties for late or non-filing of returns. KRA charges a penalty of Ksh 2,000 for individuals who fail to file their returns by June 30th of every year.

- It helps you maintain a good tax compliance record, which is required for various purposes, such as applying for government tenders, clearance certificates, or loans.

- It helps you update your tax status with KRA and avoid any future complications or disputes.

How to file nil returns on iTax?

To file nil returns on iTax, you need to have a KRA PIN and an iTax password. If you do not have them, you can register for them on the iTax portal. Once you have them, follow these steps:

- Visit the iTax portal at https://itax.kra.go.ke and log in with your KRA PIN and password.

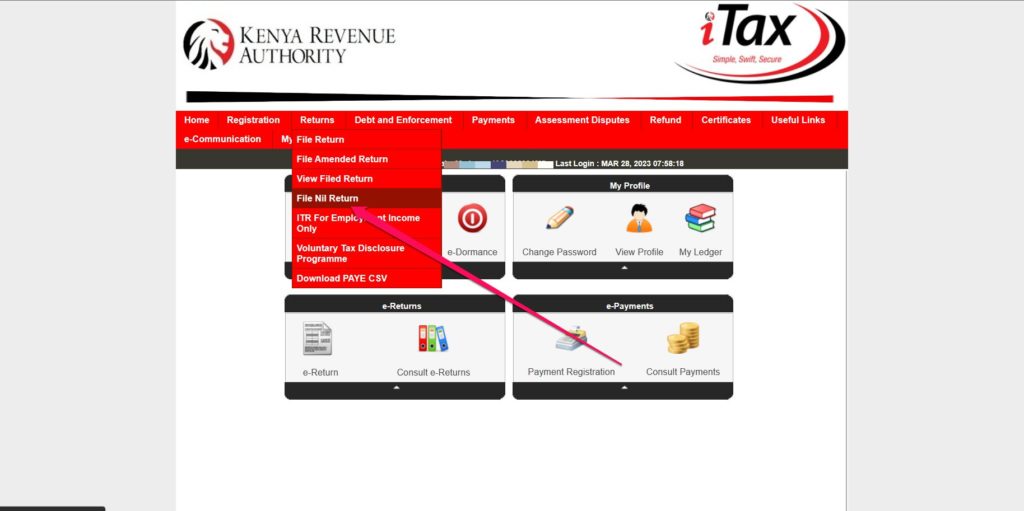

- On the dashboard, hover over the Returns menu and click on File Nil Return.

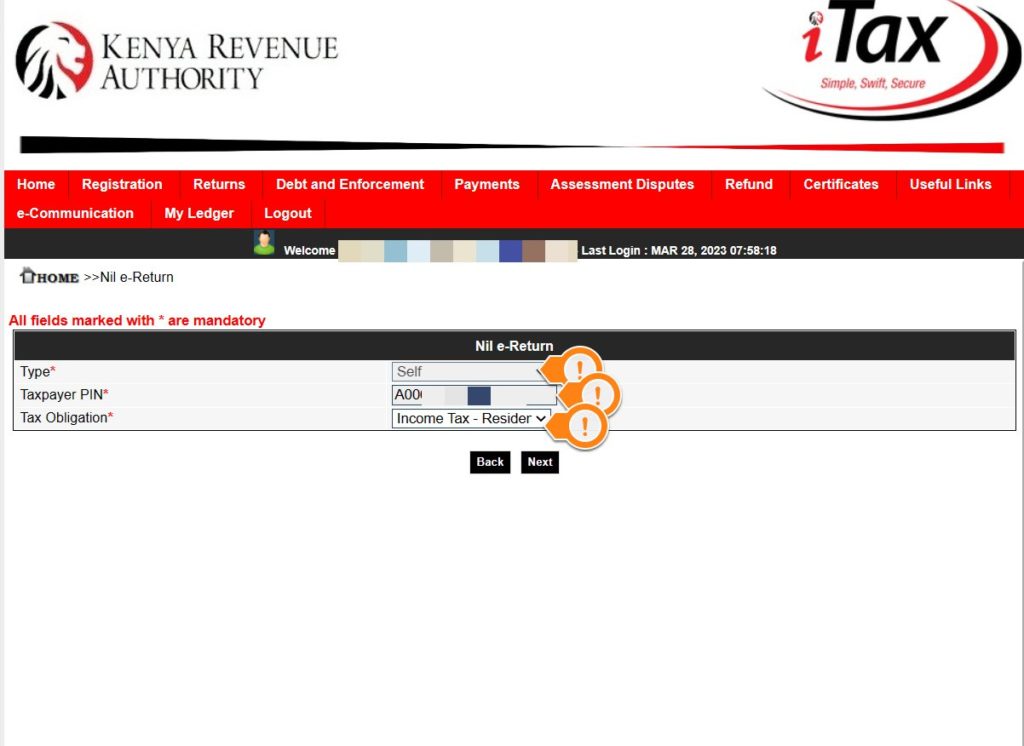

- Select the Tax Obligation as Income Tax – Resident Individual and click Next.

- Fill in your personal details, such as your name, PIN, and email address.

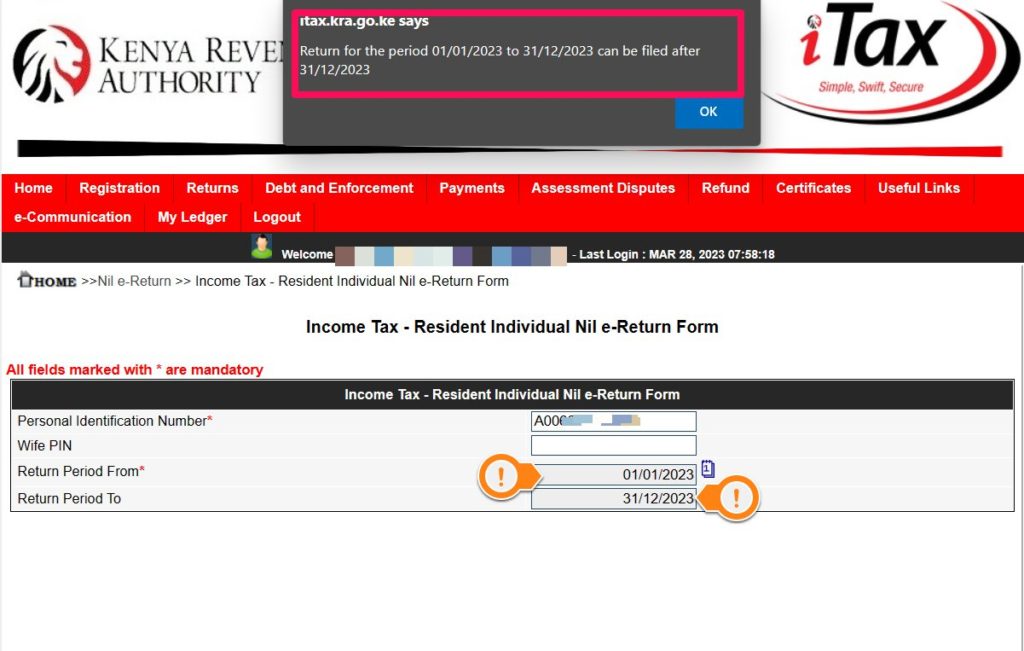

- Select the return period as January 1st to December 31st of the previous year.

- Tick the declaration box and enter your iTax password.

- Click Submit to complete the process.

Step 1: Log in to iTax

To file nil returns on iTax, you need to have an active KRA PIN and password. If you do not have a KRA PIN, you can apply for one on iTax. If you have forgotten your password, you can reset it on iTax. Once you have your KRA PIN and password, go to https://itax.kra.go.ke/KRA-Portal/ and enter them to log in to your account.

Step 2: Select Returns Menu

After logging in to iTax, you will see a dashboard with various options. Click on the Returns menu on the top bar and select File Nil Return from the drop-down list.

Step 3: Choose Tax Obligation

On the next page, you will see a form where you need to choose your tax obligation. Select Income Tax – Resident Individual from the list and click Next.

Step 4: Fill in the Return Period

On the next page, you will see another form where you need to fill in the return period. This is the year for which you are filing nil returns. For example, if you are filing nil returns for 2022, enter 01/01/2022 as the From Date and 31/12/2022 as the To Date. Then click Submit.

Step 5: Download the Acknowledgement Receipt

On the next page, you will see a confirmation message that your return has been submitted successfully. You will also see a link to download your acknowledgment receipt. This is a document that proves that you have filed your nil returns. Click on the link and save the receipt on your device or print it out for future reference.

You have now completed the process of filing nil returns on iTax, the KRA Portal. You should file nil returns every year if you have no taxable income to report. This will help you avoid penalties and maintain a good tax compliance record. For more information on tax matters, visit https://www.kra.go.ke/en/.

You will receive a confirmation message and an acknowledgment receipt with a reference number. You can download or print the receipt for your records.

That’s it! You have successfully filed your nil returns on iTax. You can also check your tax compliance status on the iTax portal by clicking on Compliance Certificate under the Certificates menu.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.