Are you in the United States, Canada, the UK, or anywhere abroad? Do you plan to send money to Nigeria at any point? If yes, this article will let you know the top 8 platforms to use in 2023.

Sending money from a foreign country to Nigerian bank accounts can be a nightmare, especially considering that Nigeria has been blacklisted by major global cross-border platforms like Paypal. If you always used wire transfers to send money to Nigeria, you should be able to recount how costly its charges are currently. But with any of these alternatives, you can send money to Nigeria quickly and hassle-free.

1. Grey

Grey is a digital banking platform tailored for Nigerians, freelancers, and remote workers. With Grey, you can open virtual USD, GBP, and EUR accounts, receive international payments, and convert to naira at competitive rates. As of 2025, Grey supports instant USD virtual accounts, low transaction fees, fast transfers, multi-currency support, and USDC deposits. Grey is especially popular for freelancers and digital nomads who want to avoid high bank fees and long waits.

Official site: https://grey.co

Fees: Low, varies by corridor

Exchange Rate: Competitive, close to mid-market

Speed: Instant to hours

User Reviews:

★★★★☆ (App Store 4.5/5)

Praised for reliability, speed, and transparency.

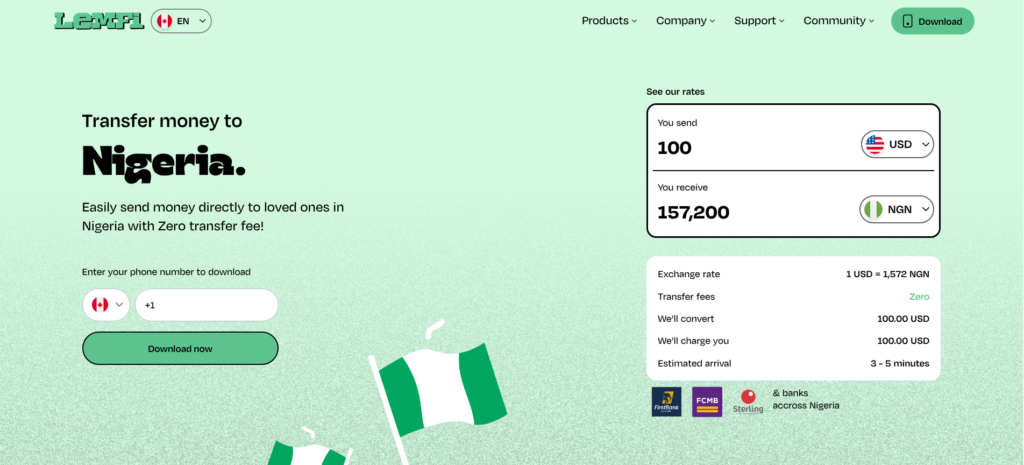

2. LemFi

LemFi (formerly Lemonade Finance) is a cross-border money transfer app focused on Africans in the diaspora. LemFi lets users in the UK, US, Canada, and Europe send money instantly to Nigerian bank accounts and mobile wallets. It’s known for zero transfer fees, competitive rates, and instant delivery. In 2025, LemFi remains a favorite for Nigerians abroad due to its simplicity and reliability.

Official site: https://www.lemfi.com

Fees: No transfer fee

Exchange Rate: 1–2% above mid-market

Speed: Instant to Nigerian banks and wallets

User Reviews:

★★★★☆ (App Store 4.6/5)

Praised for speed, but some users want more payout countries.

3. Afriex

Afriex is a remittance app built for Africans worldwide. It allows users to send and receive money between the US, UK, Nigeria, Ghana, and Kenya. Afriex offers free transfers and competitive exchange rates. In 2025, Afriex continues to stand out for supporting crypto and fiat transfers, making it a flexible choice for tech-savvy users.

Official site: https://www.afriexapp.com

Fees: No transfer fee

Exchange Rate: 1–3% above mid-market

Speed: Instant to Nigerian banks

User Reviews:

★★★★☆ (App Store 4.4/5)

Users love the free transfers and crypto support.

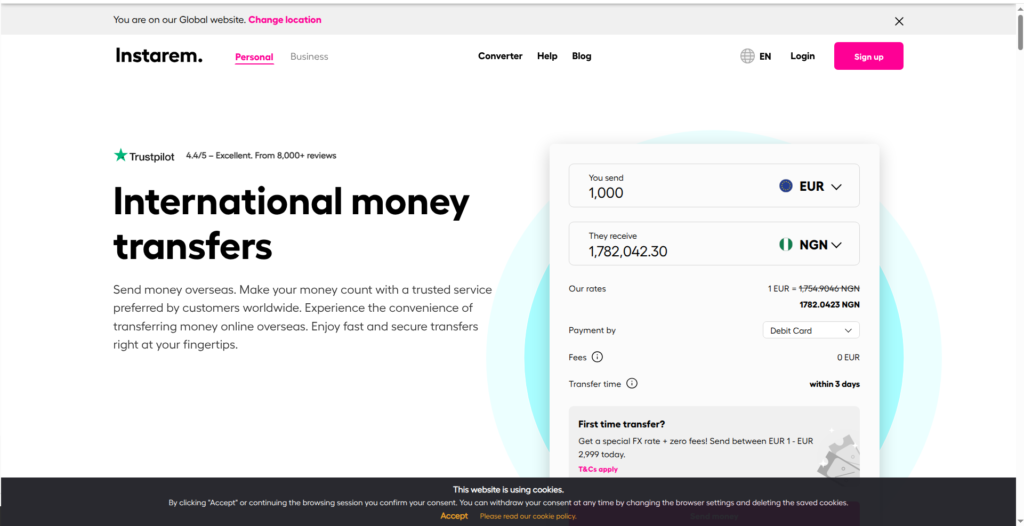

4. Instarem

Instarem is a global money transfer service that lets users send money to Nigeria from over 60 countries. Instarem is known for low fees, transparent rates, and fast delivery. In 2025, it’s a top pick for those who want to avoid hidden charges and get competitive rates on large transfers.

Official site: https://www.instarem.com

Fees: Low, varies by corridor

Exchange Rate: 0.5–1.5% above mid-market

Speed: 1–2 business days

User Reviews:

★★★★☆ (Trustpilot 4.3/5)

Praised for transparency and speed.

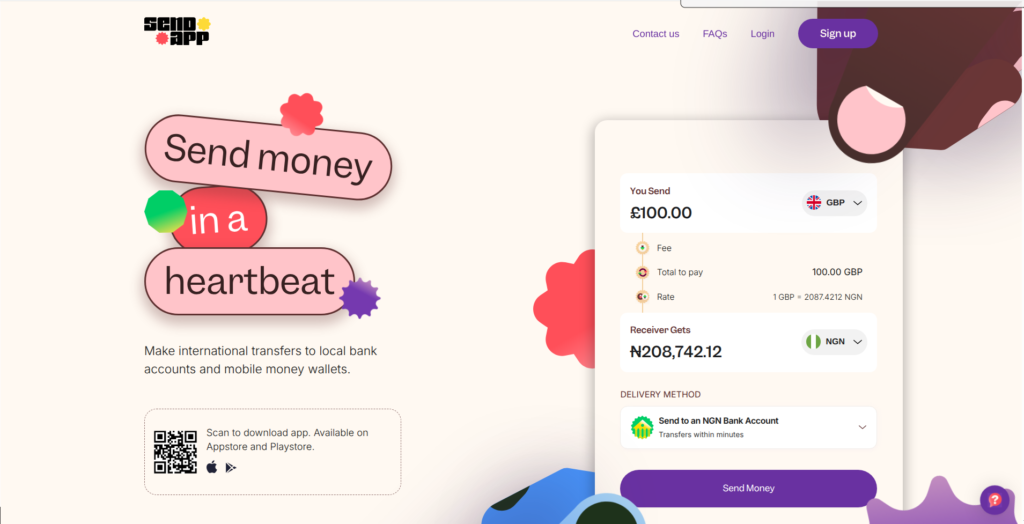

5. Send by Flutterwave

Send by Flutterwave is the remittance solution replacing Barter. It enables users to send money from the US, UK, EU, and Canada to Nigeria and other African countries. Send by Flutterwave offers instant delivery to Nigerian bank accounts and mobile wallets, with transparent fees and strong security. In 2025, it’s one of the most reliable ways to send money home to Nigeria.

Official site: https://send.flutterwave.com

Fees: Low, varies by country

Exchange Rate: 1–2% above mid-market

Speed: Instant to Nigerian banks and wallets

User Reviews:

★★★★☆ (App Store 4.5/5)

Praised for speed and ease of use.

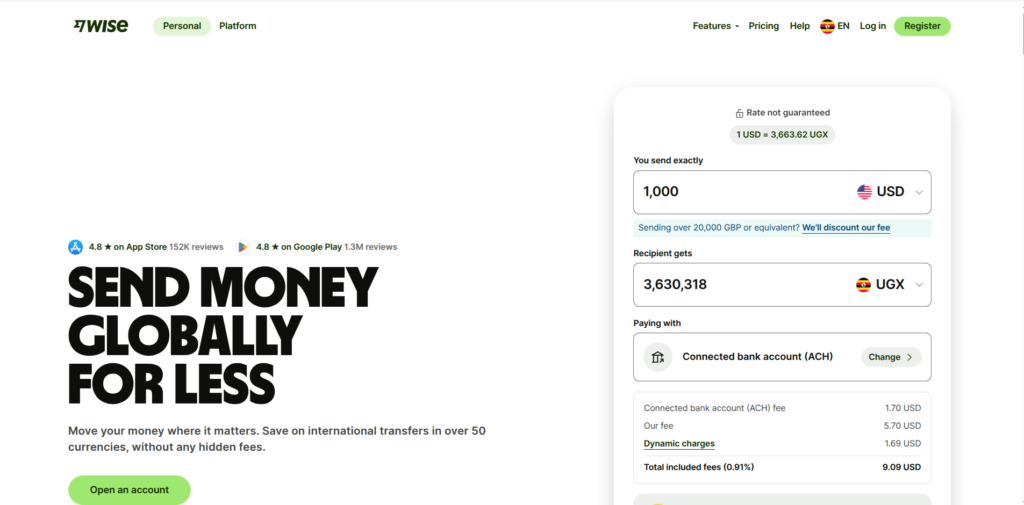

6. Wise (formerly TransferWise)

Wise is a favorite for sending money to Nigerian bank accounts. It uses the real mid-market exchange rate (no markup), and fees are among the lowest you’ll find. Wise is transparent: you see all fees and the exact amount your recipient will get before you send. Transfers to Nigeria are usually completed in 1–2 business days.

Official site: https://wise.com

Fees: ~0.6–1.2% of the amount + small fixed fee

Exchange Rate: Real mid-market rate, no markup

Speed: 1–2 business days to bank accounts

User Reviews:

★★★★★ (Trustpilot 4.5/5, 200,000+ reviews)

Users love transparency and low costs; some wish for more cash pickup options.

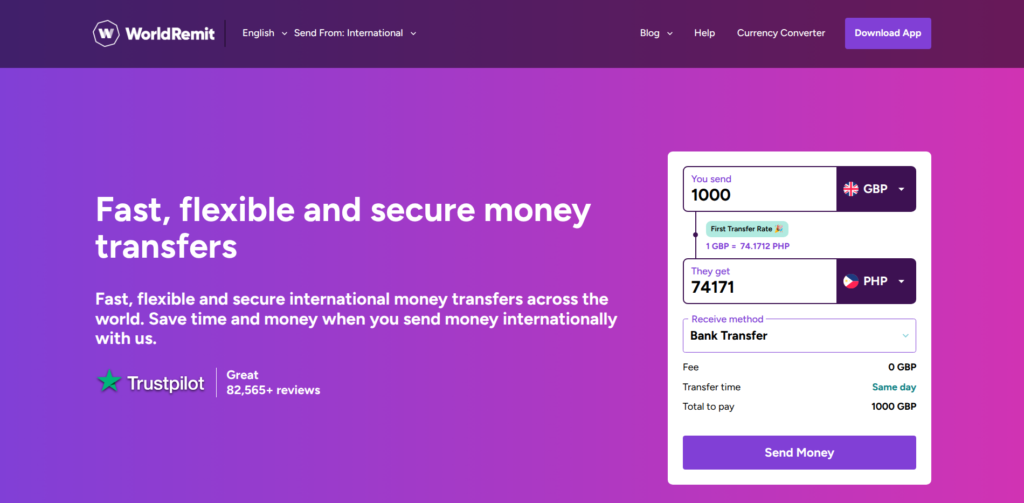

7. WorldRemit

WorldRemit is widely used for sending money to Nigeria, supporting bank deposits, airtime top-up, and cash pickup. It’s easy to use, works in over 130 countries, and delivers most transfers instantly or within a few hours. WorldRemit is known for its reliability and transparency. You’ll see the fees and exchange rate before you send, so there are no surprises.

Official site: https://www.worldremit.com

Fees: $2.99–$4.99 per transfer (varies by corridor)

Exchange Rate: 1–2% above mid-market

Speed: Instant to bank or cash pickup

User Reviews:

★★★★☆ (Trustpilot 4.1/5, 80,000+ reviews)

Praised for speed and reliability, but some report occasional delays.

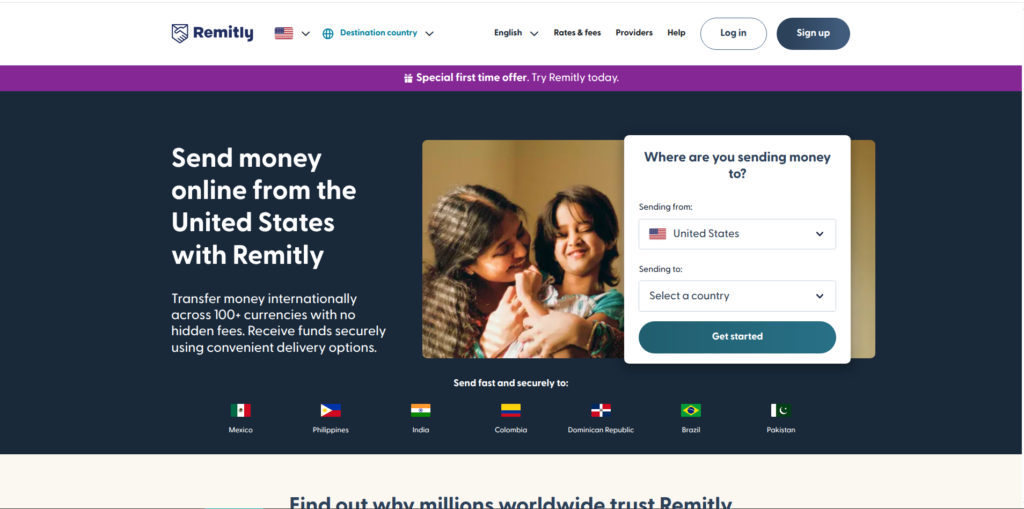

8. Remitly

Remitly lets you send to Nigerian bank accounts or for cash pickup. You can choose “Express” for instant delivery (higher fee) or “Economy” for a lower cost if you’re not in a rush. The app and website are user-friendly, and you can track your transfer status easily. Remitly is popular with Nigerians in the diaspora because of its wide reach and fast delivery. The service is regulated and secure, with clear upfront pricing.

Official site: https://www.remitly.com

Fees: $1.99–$4.99 (Express), $0.99–$2.99 (Economy)

Exchange Rate: 1–2.5% above mid-market

Speed: Express is instant; Economy takes 1–3 days

User Reviews:

★★★★☆ (Trustpilot 4.1/5, 40,000+ reviews)

Fast delivery, but some users report ID verification issues.

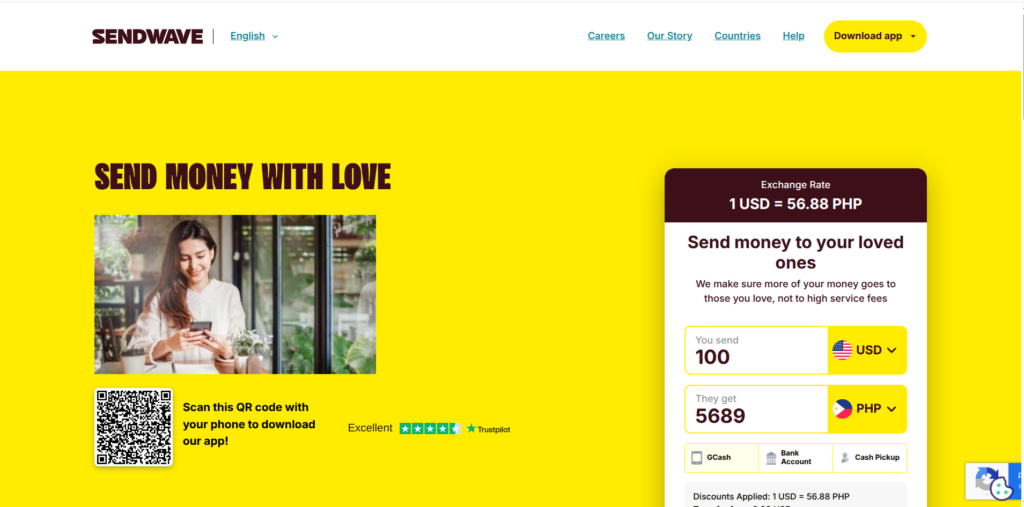

9. Sendwave

Sendwave is a mobile app for instant, fee-free transfers to Nigerian bank accounts. It’s simple: download the app, link your debit card, and send money directly to a Nigerian account. Sendwave doesn’t charge a transfer fee, but makes money on the exchange rate. It’s best for small, fast transfers and is popular with families sending money from the US, UK, and Europe.

Official site: https://www.sendwave.com

Fees: No fee (they make money on the exchange rate)

Exchange Rate: 3–5% above mid-market

Speed: Instant to bank account

User Reviews:

★★★★☆ (Trustpilot 4.6/5, 10,000+ reviews)

Users love the simplicity and speed, but rates are less transparent.

10. Payoneer

Payoneer is a widely used platform that allows individuals and businesses to receive international payments in multiple currencies. It is particularly popular among freelancers, e-commerce sellers, and professionals who work with global clients. Users can receive USD, EUR, and GBP funds and withdraw them to a Nigerian bank account.

Official site: https://www.payoneer.com

Fees: Low, varies by corridor

Exchange Rate: 1–3% above mid-market

Speed: 1–2 business days

User Reviews:

★★★★☆ (Trustpilot 4.2/5, 50,000+ reviews)

Popular with freelancers and businesses.

11. Western Union & MoneyGram

Western Union and MoneyGram remain traditional options for receiving international payments in Nigeria. These services allow individuals to collect cash from local agents or deposit it directly into their bank accounts. However, they may not be the best choice for those looking for how to receive USD in Nigeria without limits, as they often have restrictions and high fees.

Official site: https://www.westernunion.com | https://www.moneygram.com

Fees: $5–$10 (varies by corridor)

Exchange Rate: 3–6% above mid-market

Speed: Cash pickup is instant; bank 1–2 days

User Reviews:

★★★☆☆ (Trustpilot 3.8/5, 30,000+ reviews)

Widely available, but higher fees and rates.

More Resources

Want to send money to Uganda? Check out our guide: The 7 Best Ways to Send Money to Uganda (2025 Guide)

Sending money to Kenya? Read: The 7 Best Ways to Send Money to Kenya Online (2025 Guide)

Learn how to use Chipper Cash for cross-border transfers: Send Money from the US/UK to Uganda & 7 African Countries with Chipper Cash

Discover more from Dignited

Subscribe to get the latest posts sent to your email.