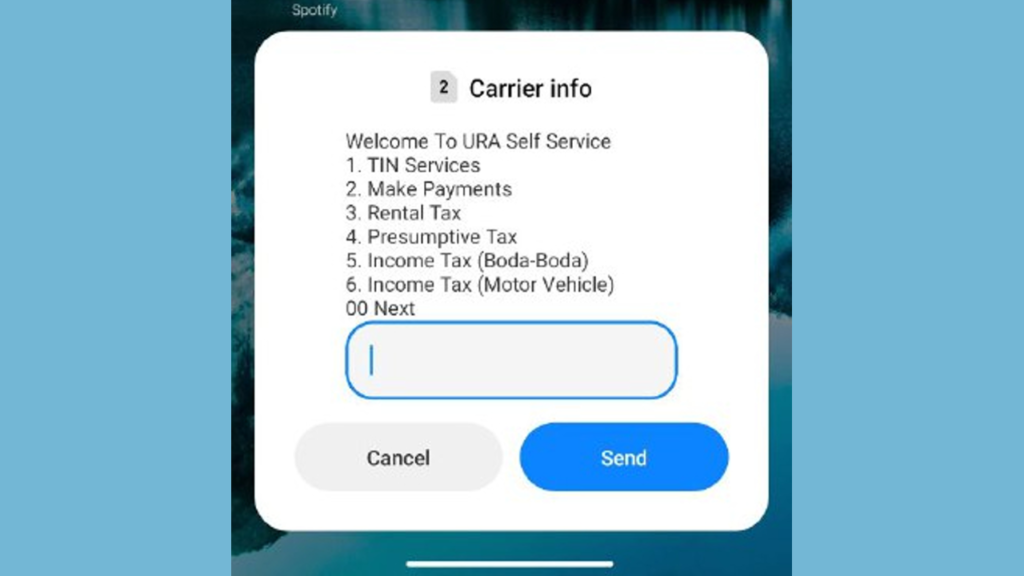

In a bid to make the process of tax payment more convenient and accessible, the Uganda Revenue Authority (URA) has recently rolled out a new USSD shortcode: *285#. This feature allows users to seamlessly pay their taxes and access crucial Tax Identification Number (TIN) services with just a few taps on their mobile phones.

TIN Services

One of the standout features of the *285# USSD code is its ability to provide quick and easy access to TIN services. Users can now check the status of their TIN – whether it’s active or not – and identify the various types of taxes associated with it, ranging from income tax to import and export duties. To access this information, simply enter your email, phone number, or National ID Number(NIN), and voila! Your TIN details are at your fingertips.

Tax Payments

With the new USSD shortcode, making tax payments has never been easier. Users can either pay with an existing Payment Registration Number (PRN) or generate a new one, facilitating the payment of various related taxes. Landlords can also use this streamlined method to pay their rental taxes, ensuring their properties are always available on the market and tenants are not inconvenienced.

Also, small businesses, especially those with total sales falling between Ugx 10,000,000 and 150,000,000 annually, can benefit from the USSD code’s functionality for paying their presumptive tax. The ease of payment extends to specific sectors, such as Boda Boda and motor vehicle income tax.

The good and bad

This new USSD application, with its simplicity and speed, stands as a welcome alternative to the URA website. Often criticized for being slow and cumbersome on smaller devices, the USSD code addresses these concerns, offering a more efficient means of tax management. Moreover, the offline capabilities of the USSD application prove invaluable in areas with slow or limited internet access.

However, while the USSD code brings a host of advantages, it’s essential to acknowledge its limitations. The session terminates every 180 seconds, which means that users must complete transactions swiftly. Additionally, the USSD service may not be toll-free, requiring users to have sufficient airtime for access.

Exploring Third-Party Options

Though the URA USSD code marks a leap forward in convenience, it’s crucial to recognize that alternative options exist. Many banks such as Stanbic for instance, offer tax payment services through their applications, and mobile money services like MTN Mobile Money provide a seamless channel for settling URA dues. The variety of choices empowers you to select the platform that best aligns with your preferences and circumstances.

So I think that the introduction of the URA USSD code *285# represents a significant stride towards simplifying tax-related processes in Uganda. With a plethora of options at our disposal, keeping the taxman at bay has never been more straightforward.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.