We know that Quickbooks has set a gold standard for accounting software targeted towards SMEs. A number of Small Enterprises in Uganda can’t do without this software. But a number of problems have emerged; first the cost of this software is way to high for typical small businesses to afford (unless ofcourse you go the piracy route). Secondly, these softwares are not customized for specific regions such as African.

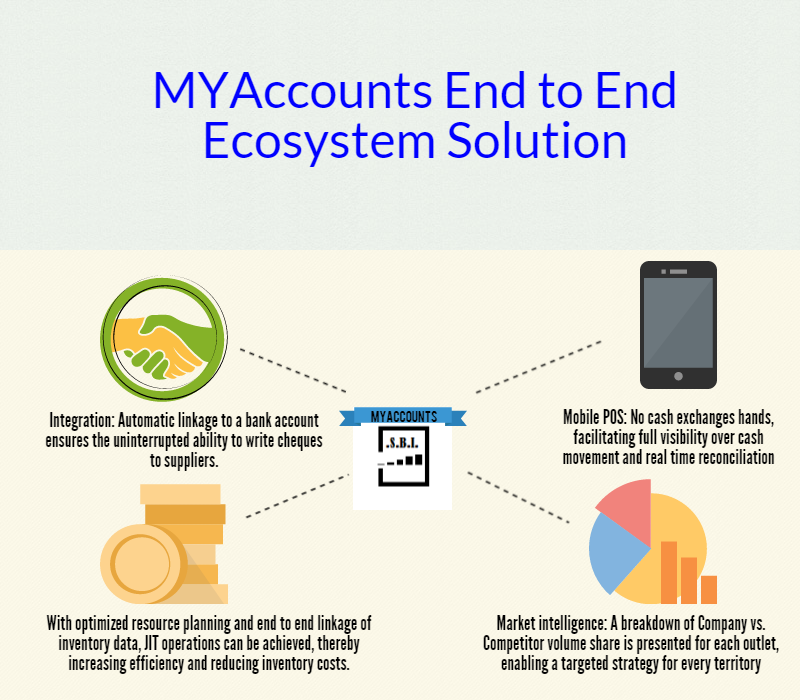

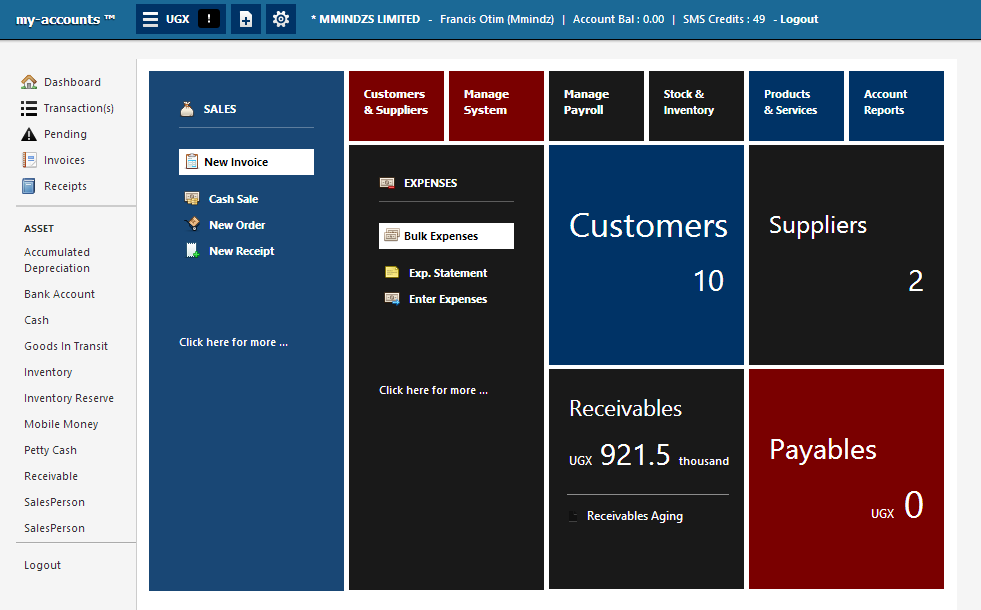

Meet MYAccounts; the first of its kind in sub-Sahara Africa, the platform is the world’s first mobile money-integrated accounting solution, around which custom features for companies operating in any business environment have been built.

We already mentioned the software among the top 5 Enterprise applications changing the way businesses operate in Uganda. The platform is developed by Smart Business Intelligence (SBI), a company specialized in the development and exploitation of technology and technology-driven processes for African businesses.

“At SBI, our mission is to fuse commerce with technology, delivering business-savvy technological applications to the continent’s consumer business and telecommunication giants.” — Francis Otim, the CEO said.

The software is packed with a great range of features designed to make financial management in small enterprises a breeze. They include;

SBI PointOfSale: A host of transactions can now be performed right from a mobile device. It is Airtel Money and MTN mobile money-ready. Posts to Tally, Quickbooks, and MYAccounts. Real time visibility: as sales are made in the field, updates are sent automatically.

SBI Survey: Create customer (or any other data) database with simple survey app. DB updated by field staff in real time saving money and time. Advanced features include barcode scanner, GPS for route planning, photo and signature capture.

SBI Analytics: Super advanced analytics and advisory services for Large Enterprises, Governments and other large orgs. Tackles stocking, production, distribution and sales challenges among other variables.

SBI Tax: A module within MYAccounts that automates the generation of e-tax upload files in formats compatible with the relevant government body. Also allows merchant to make tax payments via Mobile Money.

SBI Skills Program: An education and empowerment program to help SMEs improve their business skills through workshops, specialized seminars, and localized handbooks on a variety of topics such as tax, accounting, company law and system use.

Focusing on MYAccounts: Some of the key modules include:

- A web based accounting system.

- Mobile money ready platform. Mobile money payments and collections are automatically reconciled to books of accounts in real time.

- Mobile Accounting (Phone, tablet) allows field transactions to be updated in real time as well as cashless field transactions for better cash and inventory controls.

- Automated e-tax submission and payment.

- SMS ordering, and SMS for CRM.

- Salesman balancing report is auto-generated, saving hours spent at the end of the day.

- Localized features directly relevant to the various markets we’re active in, and custom tailored for any user type ranging from SME to a large distributor, even a government enterprise.

The software company has partnered with Microsoft Corp., as well as Airtel Africa. Their clients range from manufacturers to distributors to SMEs such as Uganda Breweries Limited, Great Lakes Distributors, Pine Pharmacy, The Good Hair Collective, among others.

The company has some impressive figures to show for its solid product. Peter Muzoora, the General Manager of the company told this blog that they have over 1100 number of transactions executed, a combined financial value of over 339 million shillings transacted across MYAccounts platform in December 2014 alone. That’s an average of over 10 million shillings in transactions daily during December.

Featured Image: business.rutgers.edu

Discover more from Dignited

Subscribe to get the latest posts sent to your email.