Sending money to Uganda is easier than ever in 2025, but picking the right service can make a big difference in cost, speed, and convenience. I’ve personally researched and tested the most reliable options—here’s my up-to-date guide, including fees, exchange rates, and real user reviews for each provider.

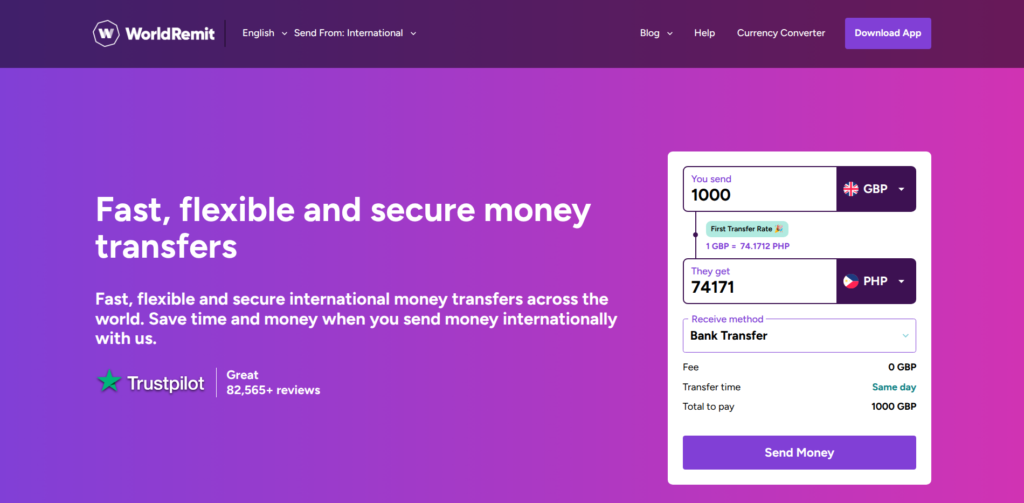

1. WorldRemit

WorldRemit is one of the most popular online money transfer services for Uganda, especially for sending directly to MTN and Airtel mobile money, local bank accounts, or cash pickup locations. I like WorldRemit because it’s easy to use, works in over 130 countries, and delivers most transfers instantly to mobile wallets or for cash pickup.

The service is known for its reliability and transparency. You’ll see the fees and exchange rate before you send, so there are no surprises. WorldRemit is especially handy if you want to send money home quickly and securely from abroad.

Official site: https://www.worldremit.com

Fees: $2.99–$4.99 per transfer (varies by country/payment method)

Exchange Rate: 1–2% margin above mid-market rate

Speed: Mobile money and cash pickup are usually instant; bank transfers in 1–2 days

User Reviews:

★★★★☆ (Trustpilot 4.1/5, 80,000+ reviews)

Users praise speed and reliability, but some report occasional delays.

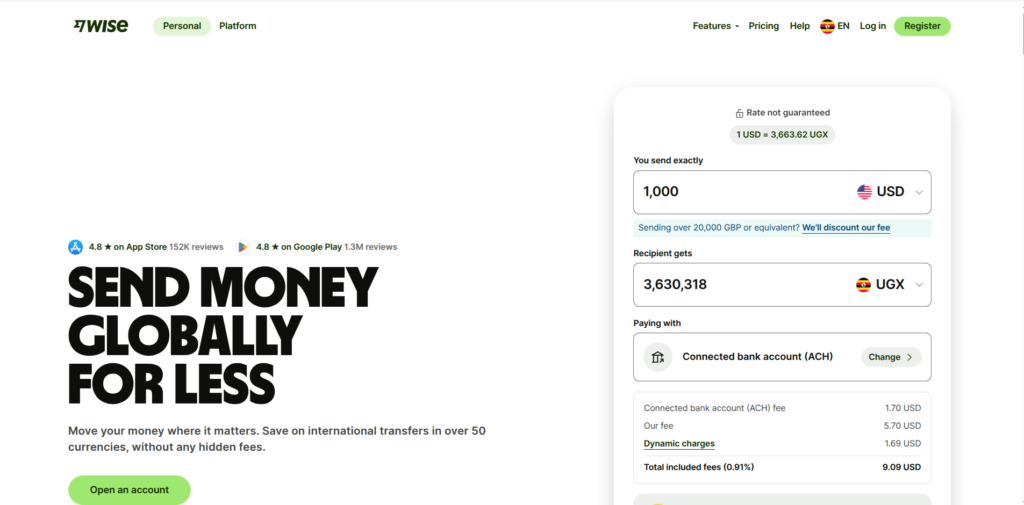

2. Wise (formerly TransferWise)

Wise is my top pick for sending money to Ugandan bank accounts. It stands out for using the real mid-market exchange rate with no hidden markup, and its fees are among the lowest you’ll find. The platform is transparent—before you send, you’ll see exactly how much your recipient will get in UGX.

Wise is best for larger bank transfers and for those who care about getting the best rate. Transfers typically arrive in 1–2 business days. While Wise doesn’t support mobile money in Uganda yet, it’s a great option for direct bank deposits.

Official site: https://wise.com

Fees: ~0.6–1.2% of the amount + small fixed fee (e.g., $1)

Exchange Rate: Real mid-market rate, no markup

Speed: 1–2 business days to bank accounts

User Reviews:

★★★★★ (Trustpilot 4.5/5, 200,000+ reviews)

Users love transparency and low costs; some wish for mobile money support.

3. Remitly

Remitly offers both speed and flexibility, letting you send to mobile money, bank accounts, or cash pickup in Uganda. You can choose “Express” for instant delivery (at a higher fee) or “Economy” for a lower cost if you’re not in a rush. I find Remitly’s app and website user-friendly, and it’s easy to track your transfer status.

Remitly is popular with Ugandans in the diaspora because of its wide reach and fast delivery. The service is regulated and secure, with good customer support and clear upfront pricing.

Official site: https://www.remitly.com

Fees: $1.99–$4.99 (Express), $0.99–$2.99 (Economy)

Exchange Rate: 1–2.5% margin above mid-market rate

Speed: Express is instant; Economy takes 1–3 days

User Reviews:

★★★★☆ (Trustpilot 4.1/5, 40,000+ reviews)

Fast delivery, but some users report ID verification issues.

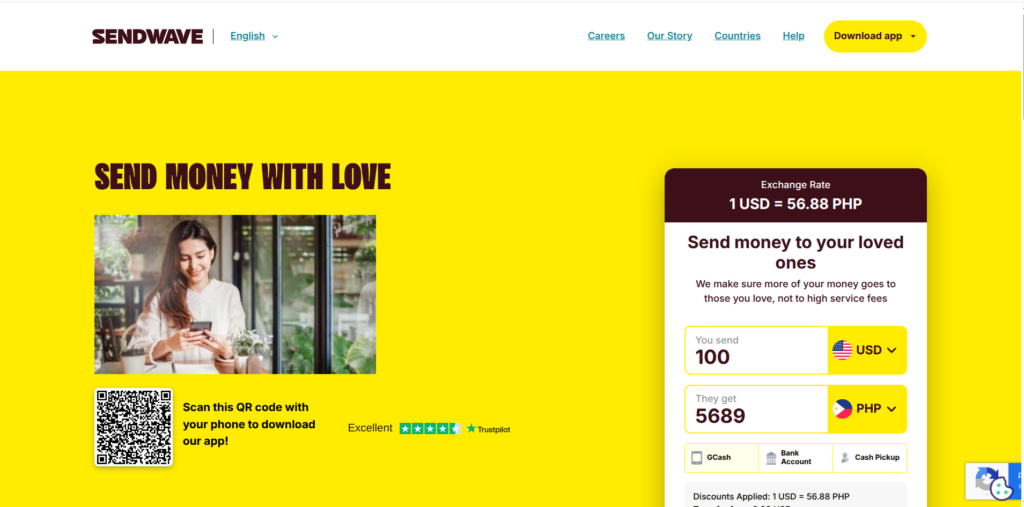

4. Sendwave

Sendwave is a mobile app designed for instant, fee-free transfers to mobile money wallets in Uganda—specifically MTN and Airtel. I like Sendwave for its simplicity: you just download the app, link your debit card, and send money directly to a Ugandan phone number.

While Sendwave doesn’t charge a transfer fee, it makes money on the exchange rate. It’s best for small, fast transfers and is especially popular with Ugandan families and friends sending money back home from the US, UK, and Europe.

Official site: https://www.sendwave.com

Fees: No fee (they make money on the exchange rate)

Exchange Rate: 3–5% margin above mid-market rate

Speed: Instant to mobile money

User Reviews:

★★★★☆ (Trustpilot 4.6/5, 10,000+ reviews)

Users love the simplicity and speed, but rates are less transparent.

5. Western Union

Western Union is one of the oldest and most established money transfer services globally, with a huge network of agent locations in Uganda for cash pickup. You can also send to bank accounts or mobile wallets, and transfers can be initiated online, via app, or in person.

Western Union is great for recipients who prefer to pick up cash or don’t have a bank account. While fees and exchange rates can be higher than digital-first competitors, its reach and reliability make it a solid choice for many.

Official site: https://www.westernunion.com

Fees: $5–$10 (varies by country, amount, and delivery method)

Exchange Rate: 3–6% margin above mid-market rate

Speed: Cash pickup is instant; bank/mobile money 1–2 days

User Reviews:

★★★☆☆ (Trustpilot 3.9/5, 30,000+ reviews)

Widely available, but higher fees and rates.

Related post: 5 tips on how to receive money in Uganda using Western Union

6. MoneyGram

MoneyGram is another well-known provider for sending money to Uganda, offering cash pickup, bank deposit, and mobile wallet transfers. Like Western Union, it has a large network of agent locations and is widely trusted for international remittances.

MoneyGram is a good choice for those who need flexibility in how funds are received. The service is reliable, but fees and exchange rates can vary, so it’s worth comparing with other options before sending.

Official site: https://www.moneygram.com

Fees: $5–$10 (varies)

Exchange Rate: 3–5% margin above mid-market rate

Speed: Cash pickup is instant; bank/mobile 1–2 days

User Reviews:

★★★☆☆ (Trustpilot 3.7/5, 20,000+ reviews)

Reliable, but fees and rates can be high.

7. Chipper Cash & Eversend (Fintech Apps)

Chipper Cash and Eversend are African fintech apps that let you send money instantly to Uganda, either to mobile money or bank accounts. I find these apps especially useful for peer-to-peer transfers, and they often have lower fees than traditional providers.

Both apps require you to register and verify your identity, but once set up, transfers are quick and convenient. They’re best for tech-savvy users and those sending money within Africa or from supported countries abroad.

Chipper Cash: https://chippercash.com

Eversend: https://eversend.co

Fees: Usually free or very low

Exchange Rate: 1–3% margin above mid-market rate

Speed: Instant to mobile money

User Reviews:

★★★★☆ (Chipper 4.4/5, Eversend 4.2/5 on app stores)

Fast and convenient, but may require KYC and have limits.

Methods That No Longer Work (2025)

PayPal to Mobile Money: No direct integration for Uganda; workarounds are needed (see our PayPal withdrawal guide).

E-Pay Kenya, Payoneer, Bitcoin/crypto for direct cash-out: Not widely supported or reliable for most users.

Related post: Send money to Nigeria through 10 different ways

Tips for Choosing the Best Service

Compare total cost (fees + exchange rate margin) before sending.

For speed, use mobile money or cash pickup.

For best rates, Wise is often cheapest for bank transfers.

Always check user reviews and support options.

Conclusion

In 2025, sending money to Uganda is fast and flexible. I recommend WorldRemit or Remitly for mobile money, Wise for bank transfers, and Sendwave or Chipper Cash for small, instant transfers. Always compare fees and rates before you send—and share your experience in the comments!

Discover more from Dignited

Subscribe to get the latest posts sent to your email.