Depending on how much you earn from whatever it is you do (job, businesses, investments, etc.), saving could come easy or hard to you. But one thing is for certain: saving is just as important as, say, eating or breathing. Either short-term or long-term, there are a lot of needs, wants, and responsibilities one could (and should) save for. Bills, vacation, rent, school fees, investment, health, unforeseen events, etc. are some of the common goals people save towards.

However, as paramount as it is, saving isn’t exactly an easy thing to do out of will — unless you’ve mastered the art of financial discipline or there’s a force that propels you to save.

In Nigeria, PiggyVest (formerly known as PiggyBank.ng) is that tech-infused force that has successfully helped over 250,000 users save a total of $20 million in less than three (3) years of operation. To enlighten users on how to join the hundreds of thousands of users saving an average of $55 (NGN 20,000) every month as well as investing in other financial instruments on the platform, we wrote this guide on how to get started with getting paid to save money you’re always tempted to spend, investing and more using other features of the PiggyVest.

Sign-up and Registration

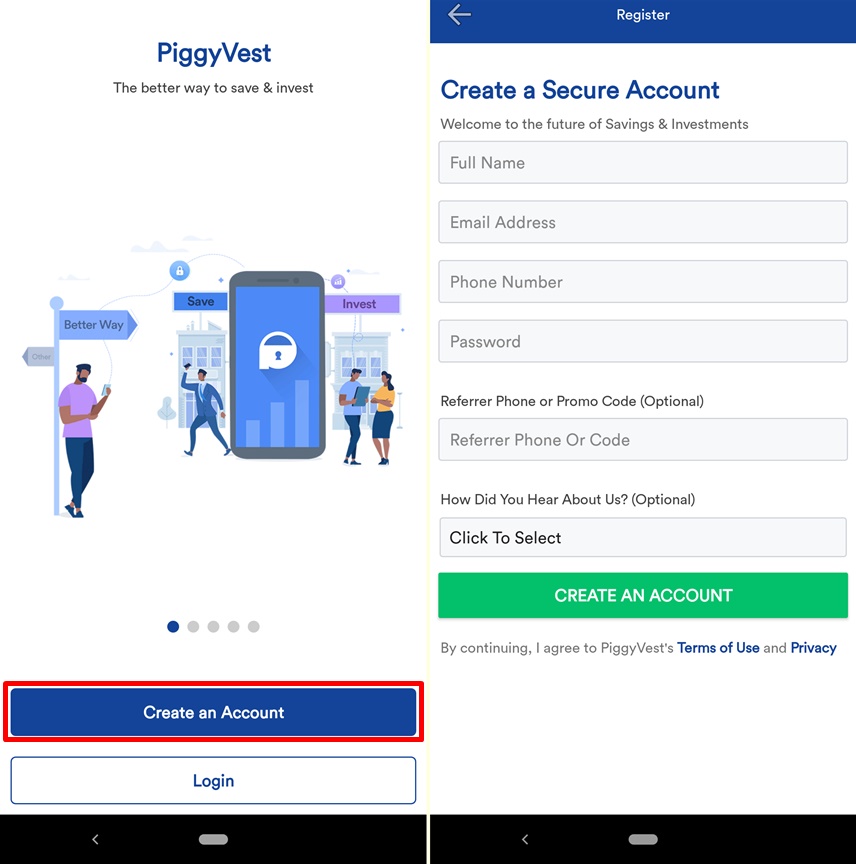

Visit the PiggyVest website to download the app on your smartphone. Launch the app after installation and tap the “Create an Account” button to set up your PiggyVest account. If you already have an account, tap the “Login” button and enter your account credentials (phone number and password) to login to your account.

When you select “Create an Account”, you will be requested to supply personal details (full name) and contact details (email address and phone number) to register a new account. You will also need to create a password which will be used for subsequent log-in. You can also input a referral code if someone referred you to register. The account creation process is pretty much easy and takes less than 3-5 minutes.

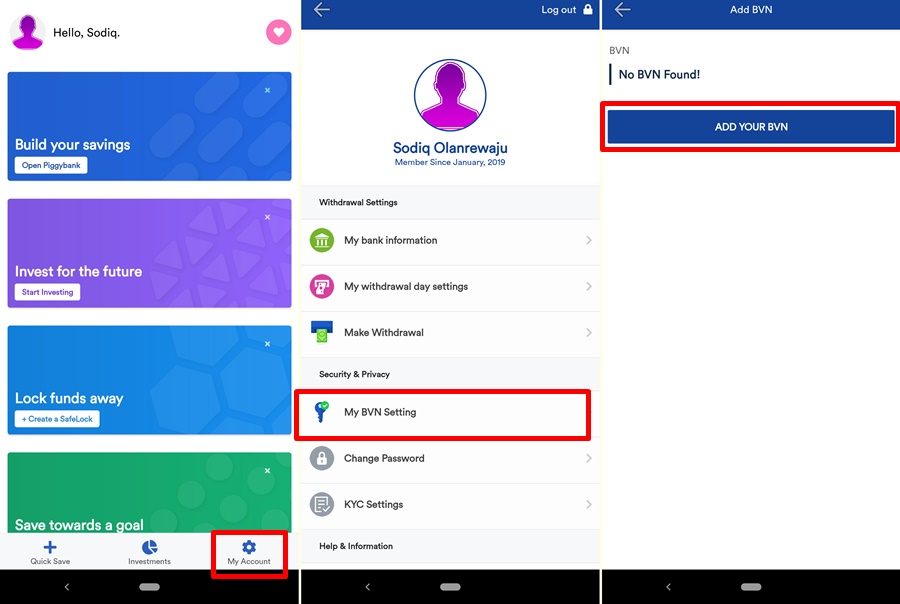

BVN Verification

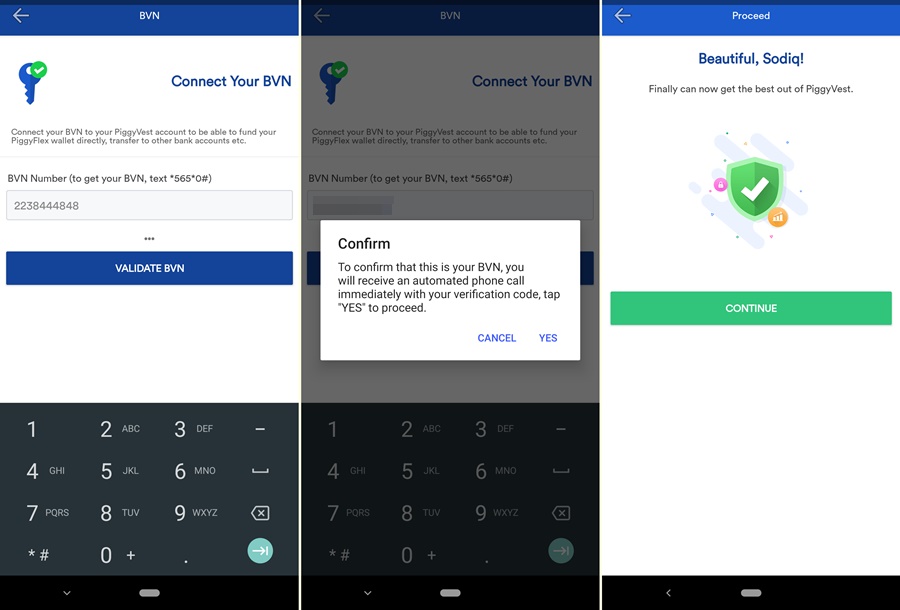

Now before you proceed to start saving and investing, you should verify your account by supplying your Bank Verification Number (BVN). BVN verification is an important step in using the PiggyVest platform as you would not be able to save money efficiently and transfer funds to and from your savings accounts within the app if you don’t verify your BVN.

To verify your BVN, tap the “My Account” settings button at the bottom of the page, navigate to “My BVN Settings” >> Add Your BVN >> Enter your 11-digit BVN number >> Validate BVN.

To confirm your BVN, PiggyVest would place a phone call to the number associated with your BVN. During the call, the automated response will call out a 5-digit verification code. Take note of this code and input it into the provided box, enter your PiggyVest password in the next box and tap the “Save BVN” button to compete the BVN verification process.

If everything checks out, a congratulatory message informing you that you can now get the best out of your PiggyVest account will displayed.

Saving

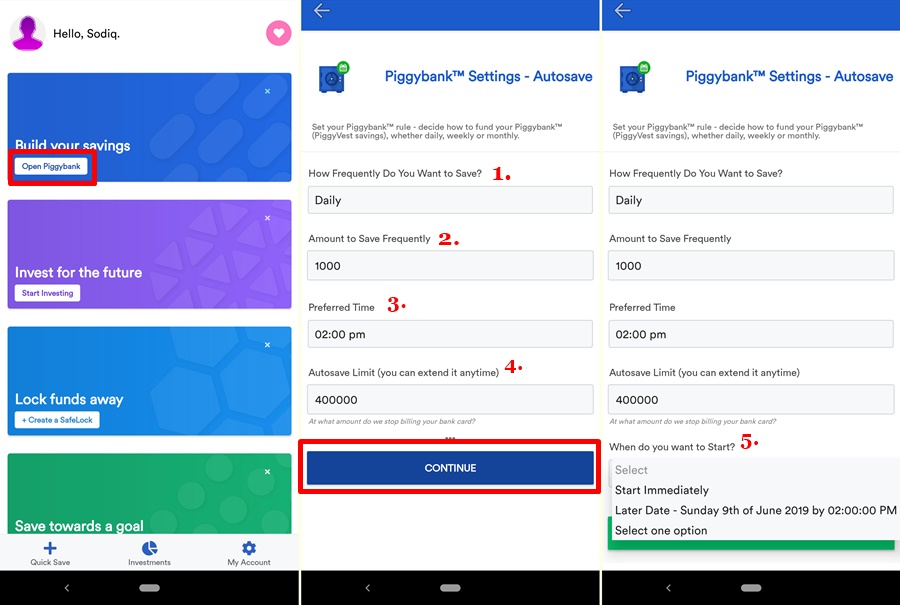

After creating or logging into your PiggyVest account, the next thing is to start saving, yes? On the PiggyVest app dashboard, select the “Build your savings” card to begin saving. Doing this will prompt you to tap the “Let’s Proceed” button to set up a saving account — Quick Save or Autosave. Before you proceed though, you will be required to add a debit/ATM card to your account by inputting your card details.

What the PiggyVest Autosave does it to automatically put away and help you save a specified amount of money from your bank account on a periodic basis; could be daily, weekly or monthly. The Autosave feature rewards you with 10% of your saving per annum. Basically, PiggyVest is not only making it easier to save but is also promoting the art of saving by rewarding users who save on its platform.

Let’s talk about the different ways you can save with PiggyVest.

Saving with PiggyVest

One thing to love about PiggyVest is its flexibility; it allows you save anytime you want, anyhow you want to. PiggyVest comes with a couple of saving features.

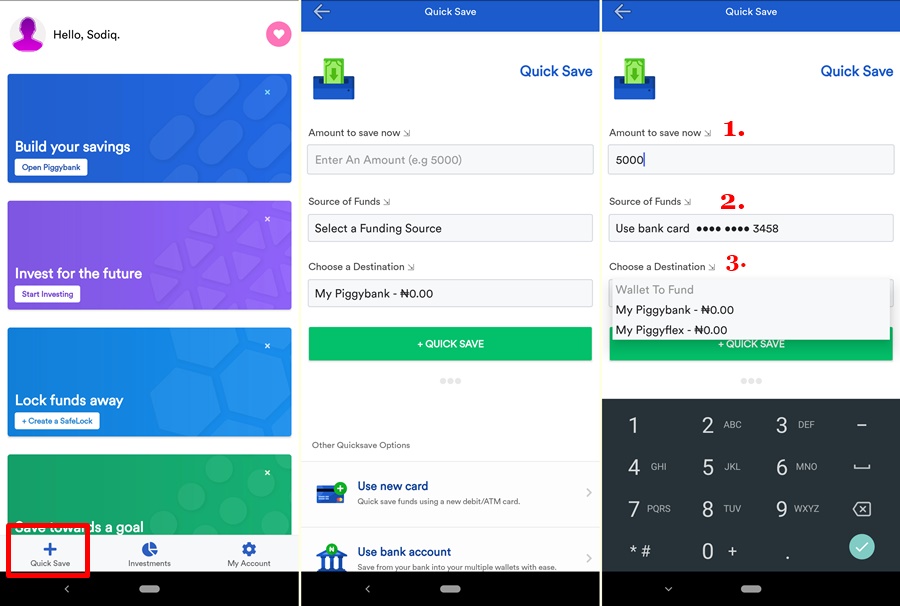

1. Quick Save

The Quick Save feature of the PiggyVest app can be compared to the traditional way of saving via physical piggybanks. Quick save, as the name denotes, allows you set aside spare funds to your PiggyVest account at any time. With Quick Save, you can save multiple times in a day, a week or a month. To save money with PiggyVest’s Quick Save feature, open the Quick Save menu, enter the amount you want to save from your bank account, select source of funds (bank card), and select where you want the money saved (PiggyBank or PiggyVest account).

NOTE: PiggyBank account is the account where all your main monies are saved while PiggyFlex account is a sub-account where all monetary interest/rewards/points earned on PiggyVest are saved. To further differentiate between the two, you can withdraw from your PiggyFlex account for free at any time while withdrawal from your PiggyBank account can only be made on fixed withdrawal dates (more in this later). Withdrawal from your PiggyBank account outside the fixed withdrawal dates attracts a penalty.

As a new user though, you won’t be able to save to your PiggyFlex account immediately as the Flex Limit is set to NGN 0. You must save to the PiggyBank account first to expand your Flex limit.

2. AutoSave

AutoSave is one of the core features of the PiggyVest app. Just like the name implies, the feature automatically sets aside (and saves) money for users. The AutoSave feature is also flexible as you can select the period you want PiggyVest to deduct a specified amount from your bank (preferably on or a day after your salary gets paid). It could also be daily, weekly, monthly or ‘anytime/manual’.

You will also be prompted to specify the amount you want PiggyVest to deduct from your bank account at the set period as well as the exact time you want the set amount deducted. Another interesting thing about the AutoSave feature is the “AutoSave Limit”. This is the maximum amount beyond which your PiggyVest AutoSave savings cannot exceed. Once you have saved up this amount in your PiggyBank account, PiggyVest will no longer deduct funds from your bank account at the set dates — unless, of course, you modify/extend the AutoSave limit.

On the app, you can navigate to “My Account” >> AutoSave Settings to modify the amount and frequency of your AutoSave plan. You can also turn off/deactivate the savings entirely by toggling off the On/Off button.

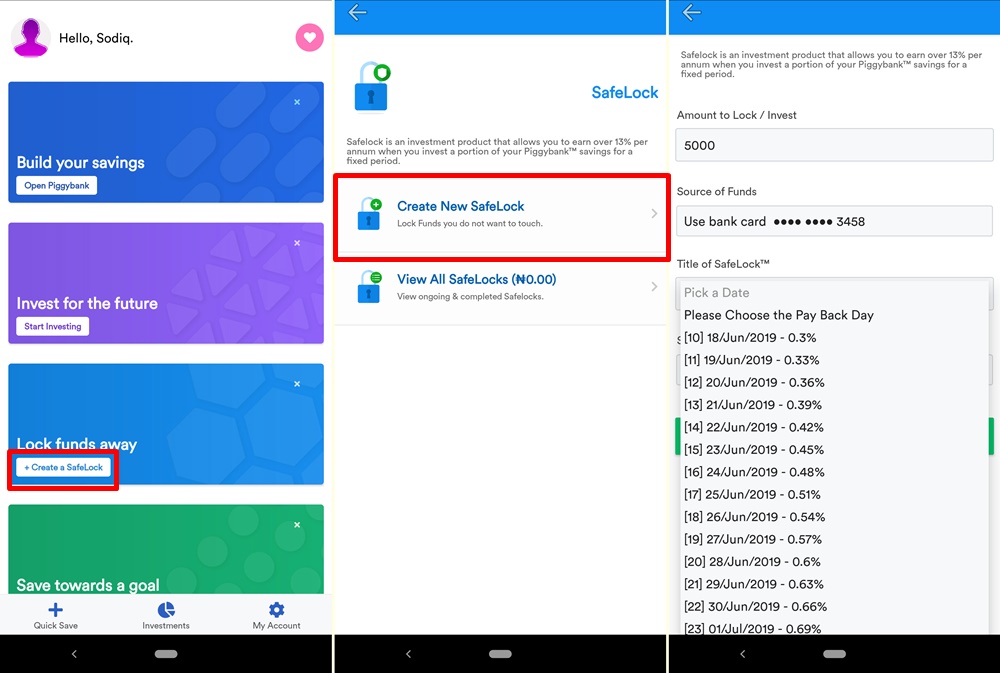

3. SafeLock

SafeLock is another core saving feature of the PiggyVest app with more stringent saving measures. SafeLock allows you put a fixed amount of money aside for a fixed period of time. And unlike AutoSave that allows you withdraw your savings on multiple dates, SafeLock keeps the fixed amount till the set time is up.

SafeLock is perfect for saving monies dedicated for non-discretionary expenses (i.e. expenses you must make e.g. rent, school fees, etc.). According to PiggyVest, SafeLock is one step further (and better) in curbing the temptation to touch/spend money that you HAVE to save. While it might be a hard thing to do, the fact that SafeLock rewards as high as 13% interest per annum on whatever amount you save should be enough motivation.

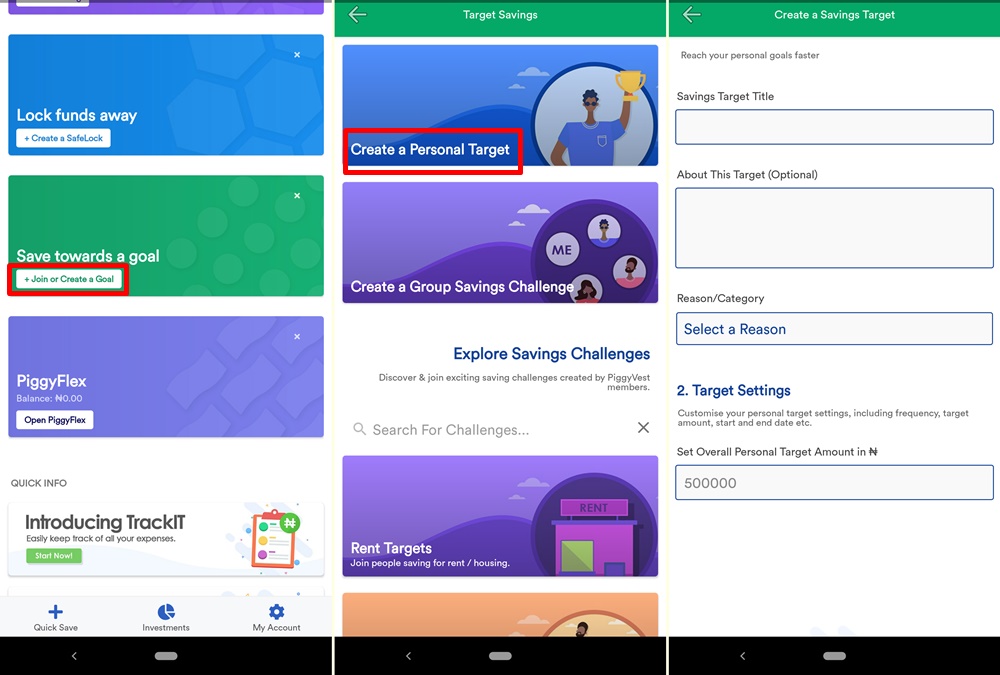

To use SafeLock on PiggyVest, tap the “Create a SafeLock” button on the Lock funds away card in the PiggyVest dashboard. Enter the amount you want to lock away, how long you want to stow the money away, as well as the payback date. You are also required to give your SafeLock a name (could be anything, perhaps the goal you’re saving towards e.g. Laptop SafeLock). You can then proceed to preview your SafeLock details and select the “Tap to SafeLock” button. The longer you lock your cash in your SafeLock, the higher the interest. The best part is that the interest on the funds you SafeLock-ed is paid upfront in your PiggyFlex account.

You should, however, remember that once you SafeLock a specific amount of money, under no circumstance will the funds be made available to you before the payback date.

4. Target Saving

Do you have a group trip you want to attend by the end of the year? Or a conference? A new laptop? A new car? Or perhaps, you intend to visit some foreign countries on vacation with your family? You can create a target saving goal separate from your personal saving. Just like regular AutoSave, you are entitled to a 10% (per annum) interest on your savings which would be paid into your PiggyFlex account daily.

To create a target saving goal or join other users saving towards a similar goal, tap the “Save towards a goal” card on the app dashboard, tap the “+” icon at the bottom of the display to get started with a personal or group target saving.

Unlike your core savings program, you can break or opt out of a target savings plan at anytime without any penalty. The funds will, however, be sent to your core PiggyBank savings account which you will then be able to withdraw only on set withdrawal days. If you have met at least 70% of your target savings, you can withdraw to your Flex account anytime for free.

Withdrawing funds

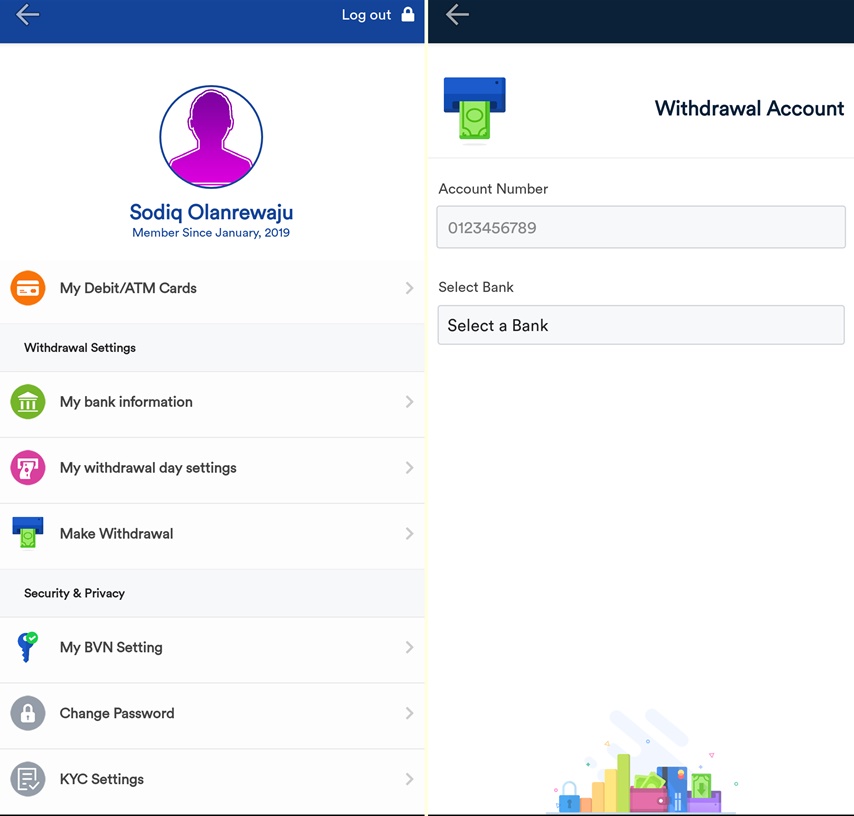

Whether you’re withdrawing monies you’ve saved for an unplanned emergency or to sort out a planned goal/expense, PiggyVest offers swift and flexible withdrawal options. Before withdrawing funds, however, there’s one important thing to do first: add your bank account details. To do this, My Account >> My Bank Information >> Go to Bank Settings >> Enter account number & Bank name

1. Withdrawing from PiggyVest account

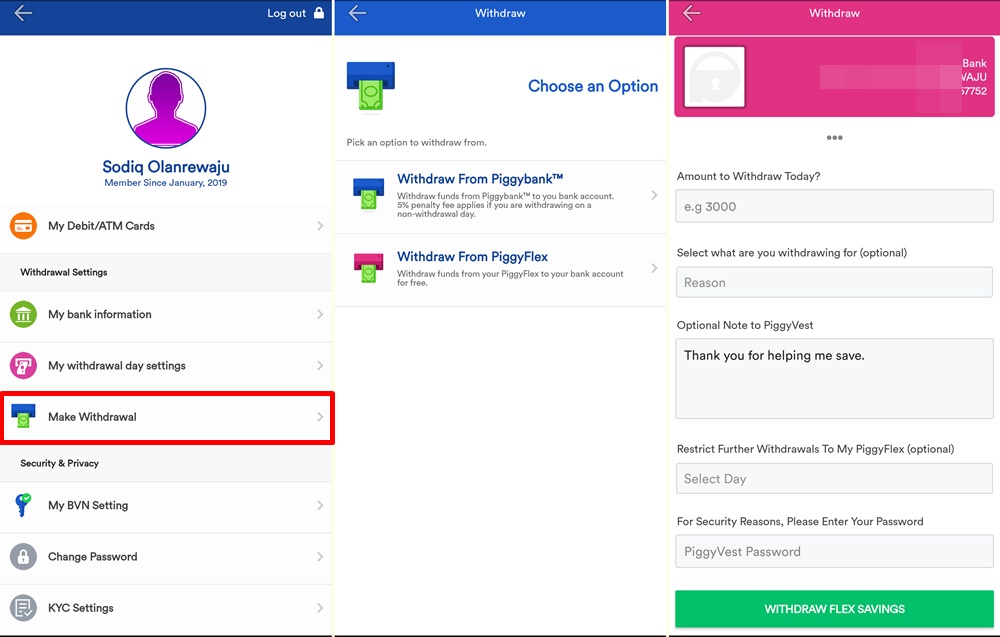

Remember that the PiggyVest account holds funds you save using the “Quick Save” option as well as interests, monetary rewards from core and special savings. That said, funds in the PiggyFlex account can be withdrawn at any time to your bank account for FREE. You can also send funds in your PiggyFlex account to your PiggyBank account as well as other users for FREE.

To withdraw cash from PiggyFlex, simply tap the “PiggyFlex” card on the app dashboard. Alternatively, you can navigate to My Account >> Make Withdrawal >> Withdraw from PiggyFlex. You are entitled to only one (1) withdrawal in 24 hours and funds are sent to your bank account within 3 hours.

2. Withdrawing from PiggyBank account

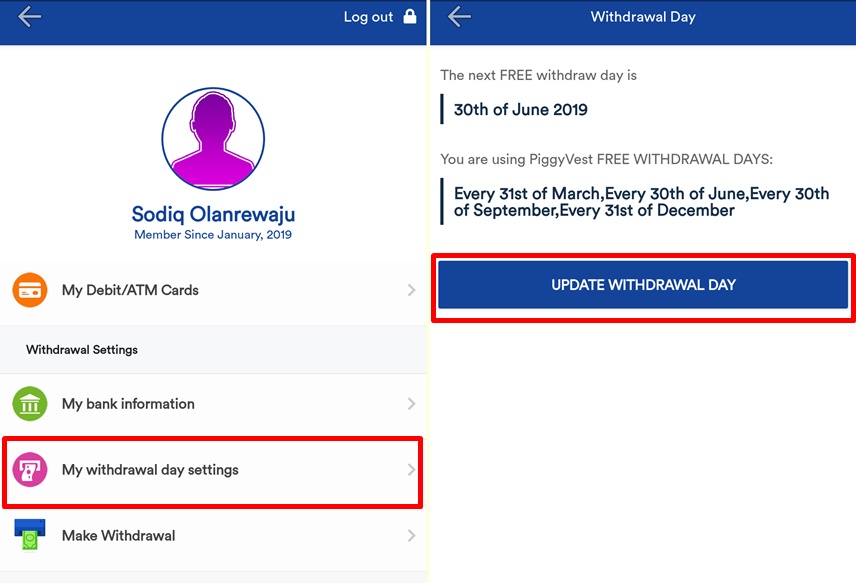

The PiggyBank account is regarded as the main savings account. If you recall, money can be saved to your PiggyBank account anytime (via Quick Save) or periodically (via Auto Save) but you can only withdraw money from the account for FREE four times per annum. These are known as “Withdrawal Days” and it is, by default, the last day of every quarter (i.e. every 3 months or 90 Days).

PiggyVest’s default withdrawal days are every 31st of March, every 30th of June, every 30th of September, and every 31st of December. You can change the withdrawal days to your preferred days/dates though. Go to My Account >> My Withdrawal day settings >> Update Withdrawal Day.

PS: If you decide to set your own convenient FREE withdrawal date, the next available FREE date will be exactly 3 months from the last time you withdrew.

Advertisement - Continue reading below

On these days, you can withdraw funds from your PiggyBank core savings account for FREE. Withdrawing on days other than your set withdrawals dates attracts a penalty payment of 5% of whatever amount you’re withdrawing. Interestingly, you can choose to pay the 5% penalty fee from your PiggyVest wallet or from the amount being deducted.

This is basically all you need to know to get started with saving on the PiggyVest platform’s app. There’s still a lot more but if you have any questions, drop them in the comments or visit PiggyVest’s Frequently Asked Questions (FAQs) page.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.