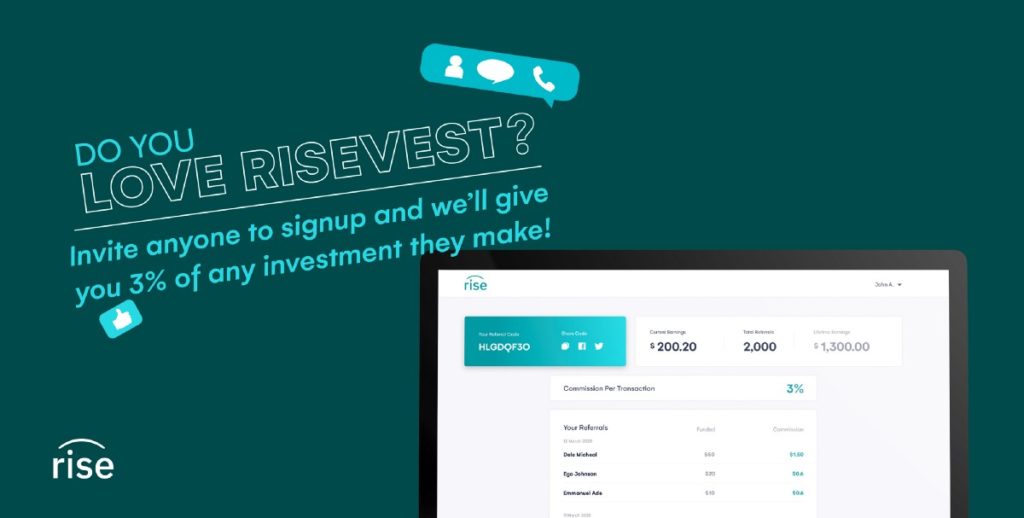

Looking to diversify your investment portfolio? This Nigerian dollar investment fintech – Risevest – allows you to choose dollar-denominated investments based on your risk appetite.

Risevest is an app that helps users invest in different vehicles and let their money work for them. With Risevest, you can set up both automated and one-time investments.

In this post, we’ll walk you through the investment app – how it works, how to set up your account, and a couple of other things you should know.

How Does Risevest Work?

RiseVest has three asset plans you can choose from. The three available plans include;

Stocks: In this plan, your investment is tied to stocks across the US market. These stocks are from RiseVest’s equity portfolio. Because it comprises of stocks, the risk level is quite high and it has a historical return of 14% Per Annum. You don’t get to choose stocks that Risevest invests in – there’s a team dedicated to that.

Real Estate: This plan invests in rented buildings across the US. Unlike stocks, its risk level is medium and it also has a historical return of 14% Per Annum.

Fixed income: For users who’d prefer to just keep their money stashed away for a specific period, the fixed income is a very low-risk plan that has a historical return of 10% Per Annum.

How Safe is Risevest?

Risevest is regulated both in Nigeria and the United States.

In Nigeria, SEC regulates this app through an agreement with ARM trustees while the founder Eke Urum is registered as an investment adviser by the United States SEC.

Put simply, this app doesn’t keep user funds in local bank accounts. So the regulated entities in the US manage all investments. This means all operations and investments are safe.

Also, the Federal High Court has given the company unfettered access to their local accounts. And so, they are compliant with all stakeholders – home and abroad.

How to Set Up a RiseVest Account

Found an asset class you’d be interested in? Here’s how to set up your RiseVest account;

- Download the Risevest App from Playstore or the iOS App Store

- Verify Your Account with your email and a valid identity card

- Once your account has been verified, tap on ‘add money’

- Fund your wallet using any of the available funding options

- Once your deposit has been recorded, tap on ‘create an investment plan’

- Choose from any of the available classes and start investing.

Minimum Investment Amount: With a minimum of $10 you can start investing with an asset class on RiseVest.

Let me know if you found this post helpful in the comment section below. You might also want to check out our Fintech section for more such stories.