Xente Tech Limited, a financial technology platform that simplifies payments and finance for businesses, has obtained the Payment Systems Operator (PSO) license from the Bank of Uganda, which opens up more opportunities for Xente to provide better financial services to businesses in Uganda.

The National Payment System Act 2020, implemented under the National Payment Systems Regulations, seeks to drive the digitization of Ugandan entities and streamline payment systems operators in Uganda.

Fintechs in Uganda SafeBoda, Wave mobile money, and mobile money services from MTN and Airtel are being managed and supervised under the National Payment Systems regulatory sandbox framework from the central bank.

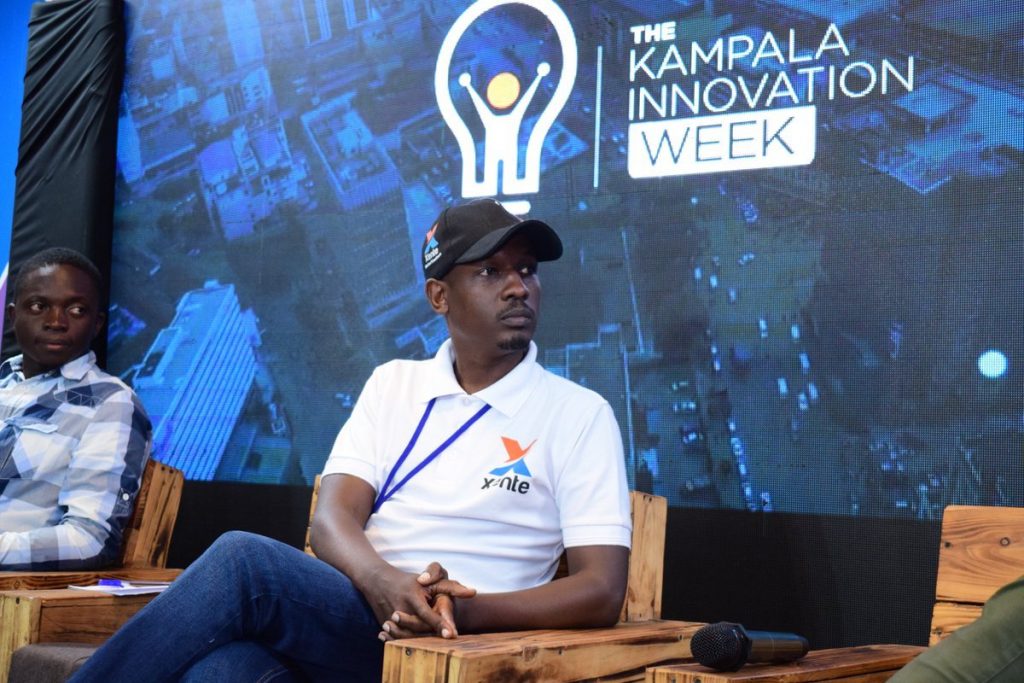

‘I am very happy to announce that we have acquired the Payment Systems Operator (PSO) license under the National Payment Systems Act issued by the Bank of Uganda. We thank the Central Bank for their diligent support, tireless effort, adherence to process, and their ability to identify us as a suitable player in the Financial Technology space in Uganda,’ said Mr. Allan Rwakatungu, the CEO & founder of Xente Tech Ltd.

READ ALSO: What Happens to Dormant Mobile Money Accounts in Uganda?

Mr. Rwakatungu explained that the acquisition of this license is a commitment to Xente customers, partners, and other stakeholders that they are offered a safe and compliant service. He pointed out that acquiring the license is another significant step for Xente towards providing world-class financial technology solutions to businesses in Africa.

With the Xente platform, businesses and their teams make simple payments to teams, suppliers, and other beneficiaries using physically issued VISA cards, mobile money, domestic and international bank transfers, pay bills, send airtime and data, and lots more.

Furthermore, businesses are also able to control and monitor this spending in real-time, which empowers them to manage accounting and finance complexity in one easy-to-use digital platform. Xente tech aims to solve a problem for businesses that rely on manual, cash, and/or paper payment processes by providing tools that they can use to automate everyday business payments and finance operations.

Ever since the Xente team pivoted to providing B2B services at the beginning of the pandemic, they have been making greater and more prominent strides. Currently, they assert that they are serving over 500+ professional businesses and are helping them save time by giving them the tools to eliminate or reduce manual and paper processes in their financial operations.

Fintech Startups dealing in B2B are few mostly in Sub-Saharan Africa and Xente tech are a few of those building infrastructures to help businesses across the continent leverage digital payments. Share with us in the comment section your thoughts about Xente tech’s new PSO license and if you see the company doing even bigger things.

Discover more from Dignited

Subscribe to get the latest posts sent to your email.