Kenyans are last minute people and June 30th is the deadline for filing your Returns with the Kenya Revenue Authority on their iTax portal. If you’re a Kenyan above 18 years with a KRA PIN, then you’re supposed to do this before end of this month or risk hefty penalties from the Taxman.

Below is a step-by-step guide to help you file your taxes online.

Log into your iTax account

For this you will need your KRA PIN and your password. If you don’t remember your password, reach out to KRA for assistance.

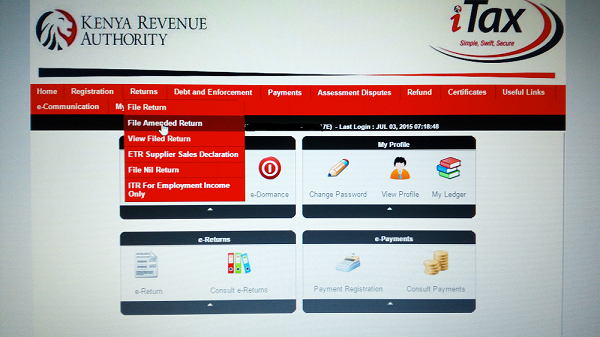

Once you log into your account on the KRA iTax system you will find this home page. Since in this instance we are submitting the annual returns, click on the Returns menu.

Choose the Returns you want to file

After you click on the Returns menu a drop down will appear. Choose the first option which is File Return‘ if you are in business. For employment income, choose the ITR For Employment Income only option. In the event that you are a student and don’t have any source of income other than your parents, choose the File Nil Return option.

In case you have already filed your return but discover that you input erroneous information. You have the option of redoing the return and filing it again. In this case you will choose the second option which is ‘File Amended Return’. You can also view the return that you have filed.

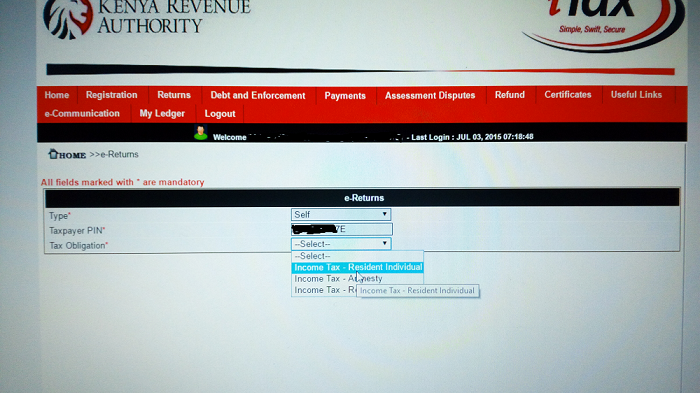

Once you click on File Returns you will move to the next page. For the purposes of this article, i selected the first option which is Income Tax-Resident Individual. After selecting the relevant option, click next.

File your returns

If you are employed and do not have extra income, you will just need to add your details onto the form.

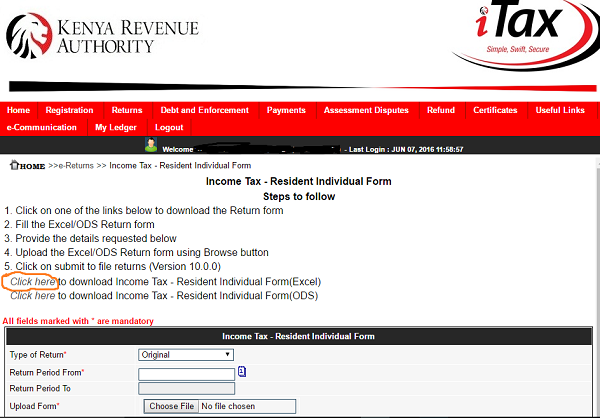

If you are employed and have extra income, you will need to download an excel sheet on which you input the relevant data. if you are in business, you will also need to download the excel sheet.

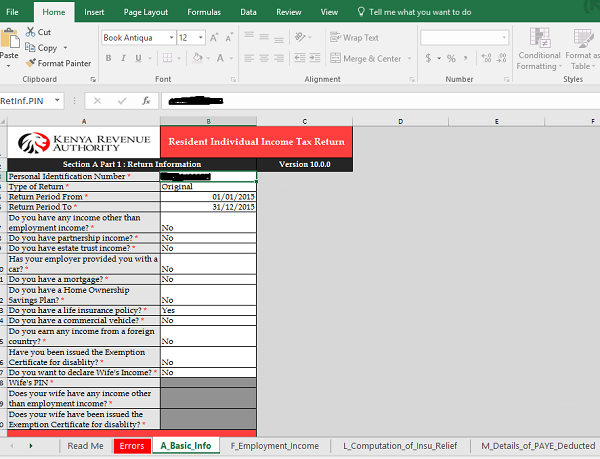

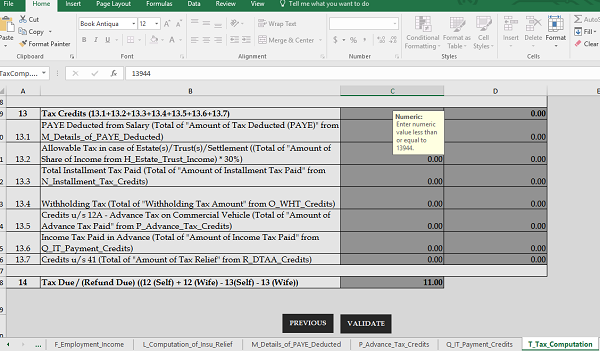

The downloaded excel sheet looks like this.

The options that you select on the Basic Info sheet, will determine the type information required from you. For example if you indicate that you have income other than employment income a profit and loss statement sheet is generated and you are required to insert details of your business.

Once you have filled all the information required in the iTax sheet, you will get to the last sheet which is Tax Computation. It basically computes all the data that you have inserted in the other sheets and shows you how much you owe the tax man if at all.

If you are satisfied with what you have inserted so far, click on validate. In the event that you have filled out all the necessary information, you will be given an option of zipping the file in readiness for uploading onto the iTax system. However, if there are areas with issues you will be redirected to the errors sheet which indicates areas that require your attention. You will have to rectify these errors before you are allowed to upload.

Upload your filed returns

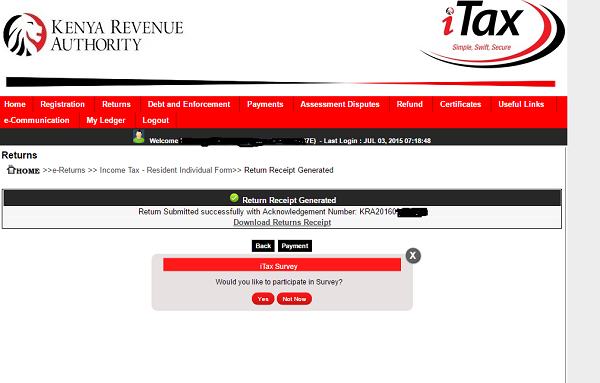

Once you have completed filling out the form and there are no errors, it is then compressed into a zip folder that you can easily upload on iTax. Ensure to indicate whether it is the original return or an amended version. Also indicate the return period which in this case is January to December 2015, agree to the terms and conditions and finally submit.

After you have submitted the return, you will receive an acknowledgement number and an email confirming that you have successfully submitted your return.

There you have it, as you have seen submitting the returns is pretty easy and you have no excuse not to do so. Ensure to submit your returns early enough so as to avoid the last minute rush.

In-post images courtesy of HapaKenya

Discover more from Dignited

Subscribe to get the latest posts sent to your email.