Uganda’s National Social Security Fund in partnership with Visa and Centenary Bank recently unveiled a 3-in-1 social security smart card dubbed the NSSF Smart Card that embeds NSSF functionality, banking capability, and loyalty program.

But how exactly does the NSSF Smart Card works? And do you need to register to get one? Let’s find out in our explainer article, let’s get started, shall we!

What Exactly Is the NSSF Smart Card?

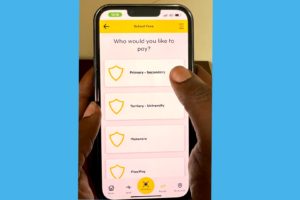

NSSF Smart Card is a membership card that allows every Ugandan to withdraw NSSF savings upon qualification for benefits, pay bills, deposit, and withdraw cash from ATMs or POS machines. The card supports financial transactions and gives access to loyalty offers while enabling NSSF functionality of contributions, remittances, and timely payment of benefits.

The fund didn’t provide many insights on how the loyalty will work and what perks and offers will come when you join the loyalty program however, my best guess is it will follow the same model as any loyalty program i.e. the more you use the card, you earn supplementary points which you can later redeem for goods or services.

In a nutshell, the NSSF smart card is an effort by the agency to replace the laminated membership card with a chip and pin card that facilitates online payments powered by VISA and supports over-the-counter transactions at Centenary bank.

It is worth mentioning the card is made up of two distinct products; the NSSF Debit Smart Card and the NSSF Prepaid Smart Card. Here are the main differences between the Debit and Prepaid NSSF Smart Card;

| Feature | NSSF Debit Smart Card | NSSF Prepaid Smart Card |

|---|---|---|

| First Deposit Amount | UGX 20,000 | UGX 50,000 |

| Minimum account balance | UGX 10,000 | N/A |

| Additional benefits | - Free ATM card - No monthly ledger fees - No annual VISA charges - Transaction SMS alerts - Issuance of monthly electronic account statements | - Free ATM card - No monthly ledger fees - No annual VISA charges - Transaction SMS alerts - Free local POS transactions - Check balance online |

| How to Withdraw Money? | N/A | Permits cash withdrawal by completing a withdrawal voucher at Centenary Bank |

How Does It Work?

The NSSF Debit Card is treated almost as if it is a bank account and attached to an NSSF Smart Life Account accessible at any branch, agent point, CenteMobile, and ATM. Your payments towards clearing out the debts are considered as deposits and can be carried out using cash at a Centenary Branch or agent point, ATM, wire transfer, mobile banking, cheque, and any acceptable means of deposit.

To ensure it is of value, card costs, monthly fees on the associated bank account, etc have been waivered. Extra charges like card withdrawal fees, Balance inquiry, Annual card fees, Card replacement, etc are still in place and cost an arm and a leg. You can read more about the full fees on the NSSF FAQ page.

READ ALSO: How to Apply for Your NSSF Midterm Benefits in Uganda?

How to Register for the NSSF Smart Card?

NSSF smart card is for all members be it you are close to getting your benefits or not. To obtain it, please visit any Centenary Bank branch and present the requirements listed below:

Debit Card requirements

- Customer’s NSSF number

- National ID

- One Passport photograph

- Card initial balance of UGX 20,000

Prepaid Card requirements

- NSSF number

- National ID

- One Passport photograph

- Card initial balance of UGX 50,000

Do You Really Need the NSSF Smart Card?

Besides providing for prompt payment of benefits to qualifying members, the card offers close to no additional value to its holders. Online purchases on international sites are capped at 2.5USD plus 5% for forex mark-up for every transaction. There are a bunch of other charges as well. When it comes to the question of do I really need the card? It becomes a query of whether you are close to getting your benefits or not. It’s better to to invest in a memebership card if your close to getting your money, otherwise there are a bunch of alternatives way cheaper and having close to no hidden fees.

Let us know in the comment section your thoughts regarding the NSSF smart card, are you getting one?

Discover more from Dignited

Subscribe to get the latest posts sent to your email.