B2B payments compared to conventional consumer-faced payments are very complex. Aside from the fact that you might need to transfer or receive a high-volume transaction on a more frequent basis, B2B payments are directly tied to a business’s cash flow. With the rise in businesses across the globe, wire transfers, electronic bank transfers and checks are no longer a sustainable way to process B2B payments online. This is why you need B2B payment providers.

Online payment solutions help businesses incorporate a payment gateway via an API to their services. That way, customers can pay for transactions directly at the checkout. In this article, we’ll be reviewing some of the benefits of using a B2B payment provider and six solutions you should try out in Africa.

Advantages of Using B2B Payment Providers

If you’re still considering whether using a B2B payment provider is the right option for you at the moment, here are a few benefits they pose to your business;

Better Reconciliation: Since all cash inflow and outflow are automatically recorded, it is easy to reconcile your accounts. In some cases, you can even integrate these providers with your other bookkeeping software.

It’s Secure: Asides from having a more defined payment trail, when you choose a good payment solution, your transactions are almost always secure. This is because you have a dedicated team of engineers working to prevent any breach.

More Cash Flow: By automating payments, your partners and customers can easily pay you. In addition to getting faster payments, you can track other payment patterns and optimize them for success.

Top B2B Payment Providers in Africa

1. Cellulant.io

Cellulant is a Kenyan payment provider that allows businesses to process all types of payments across Africa. The single web API enables businesses to collect payments, make payouts and process cross-border transfers. There are a lot of payment options available on Cellulant. Some of which include bill payments, payments for customers in-store or during deliveries, payment gateways for checkouts and online payment pages for businesses without a website or app.

These payments are collectable online or offline via mobile money, debit cards or even directly from their bank. They also have physical offices across 12 African countries including Lagos, Kampala, Nairobi and Lusaka.

2. Flutterwave

Looking for an option to collect payments globally? Well, Flutterwave is your go-to provider. With an API that boasts of being able to collect payments in 30+ currencies across the world, this Nigerian solution provides services to other businesses like Uber, MTN, Chippercash and Microsoft. Perhaps this is a result of their ISO, PA DSS and PCI DSS certifications.

With Flutterwave, you can set up recurring payments for subscription-based models and payment plans. You can also collect payments on mobile apps with SDK integration. Alongside bill payments, process local transactions in person with the available POS devices.

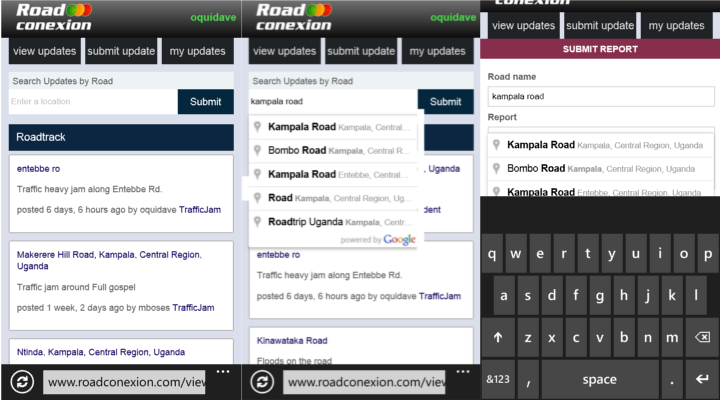

3. Pesapal

Pesapal is a B2B payment provider that offers payment solutions for businesses in Uganda. This payment gateway offers multiple payment options, it can allow you to process global transactions, and sell to both local and international customers. Pesapay is currently empowering merchants like Payway and DSTV.

Asides from accepting payment in various currencies, you have a unified connection to Mastercard, Visa and AMEX. There’s also a POS, payment gateway API, a payments page for businesses without a website and generating online invoices. What we particularly love about Pesapal is the transparent pricing. There’s a 3.5% commission on each online payment, 2/9% on every POS transaction and a $90 fee for the Sabi terminal. There are no additional monthly or sign up fees.

4. Paystack

Although Paystack doesn’t have a POS, an integration allows customers to pay for your services via a card, bank transfer, Apple pay, USSD, mobile money and so much more. This Nigerian payment solution is compatible with shopping websites like Shopify, Wix, WordPress, Magento but to mention a few. Generate online invoices and send electronic reminders for pending payments.

Each payment also gets an automatically generated receipt for both parties. You can create payment pages for when your business doesn’t have a website yet and design branded checkout forms with multiple payment options.

5. iPayAfrica

iPay Online is a Kenyan payment solution that allows businesses to receive payments online on their eCommerce and mCommerce store. You can receive bulk user payments, mobile money and via a PesaLink. Customers can also pay via their credit or debit cards. In addition to bill payments, you can track incoming payments and generate receipts for record-keeping.

6. DPO Group

Present in 23 African countries, the DPO group is a payment solution that allows customers to pay for services online anywhere in Africa through various payment methods. You can accept recurring payments for subscriptions and integrate with your store for seamless checkouts. There are many available APIs like Wix, Gravity, WooCommerce and many more for easier integrations online. You can generate invoices online along with a corresponding payment link from your dashboard.

Each payment solution is designed based on your industry. For example, eCommerce, hospitality, schools and so much more. DPO group also boasts of 24/7 fraud protection via a risk team that constantly monitors all transactions online.

This list could go on and on because there are a ton of payment providers you could choose from. However, these are our top solutions. We hope you find the right match for your needs. Do share this post with your friends and family members who might just need it.