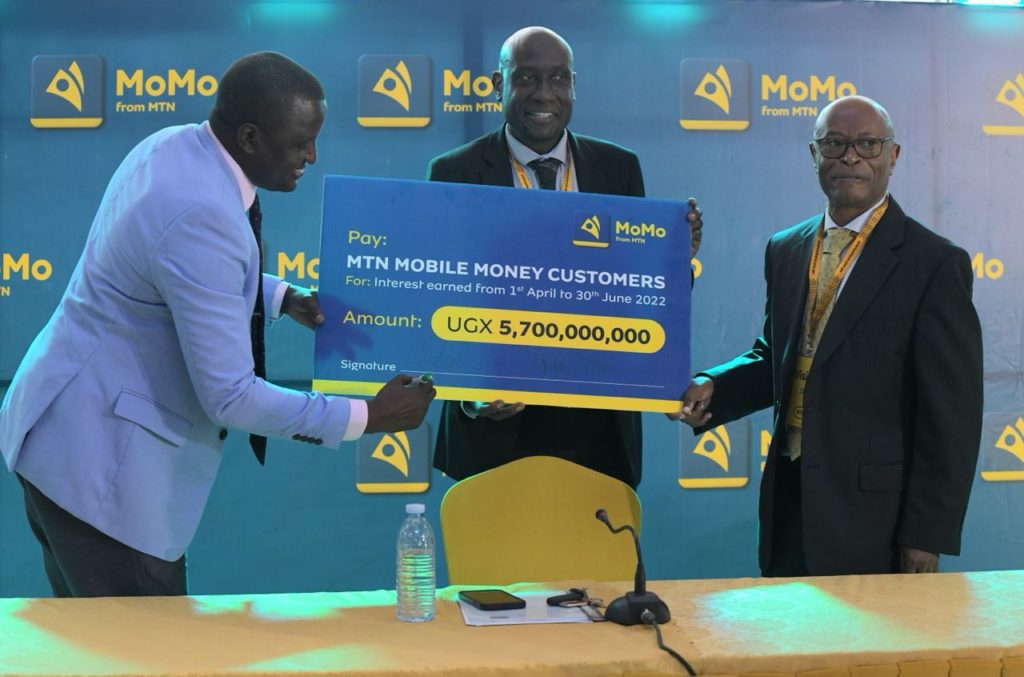

The benefits of separation of Mobile Money from the telecommunication business are beginning to be noticed as MTN Mobile Money customers are scheduled to receive UGX 5.7 billion interest pay-out for the quarter ended June 30, 2022.

MTN Mobile Money Uganda Limited was separated from its parent company, MTN Uganda, in May last year pursuant to the National Payment Systems (NPS) Act, 2020. Section 49(6) of the National Payments Systems Act (NPS) of 2020 and Regulation 14 of the National Payment System regulations of 2021 stipulates that MTN Mobile Money Uganda pays its customers interest earned on a Trust Account.

The payout follows approval by its Board of Trustees and Bank of Uganda to pay out interest to 19.8 million MoMo users who had a minimum of UGX 1 and above between 1st April and 30th June. The payments will be disbursed starting Wednesday 14th September 2022.

Mr. Richard Yego, the managing director at MTN Mobile Money Uganda said the interest will be calculated based on each customer’s daily average mobile money balance for three months.

“As MTN Mobile Money Uganda, we strongly believe that this quarterly interest paid to customers will encourage a culture of savings and create wealth and opportunities for investment, especially in medium and small businesses which use the mobile money platform intensively, “he said at the MTN Uganda headquarters in Kampala.

“We also hope that the pay-out will enhance financial resilience by bringing more people into the formal sector through Mobile Money and thus leading to substantial development and social well-being of the citizens as the country strives to achieve Vision 2040.”

Mr. Yego said customers will be notified through SMS alerts once the interest has been paid. However, the interest rates paid will be subjected to withholding tax as well as standard withdrawal charges.

The interest accrued on mobile money accounts that have not registered a transaction for fifteen (15) consecutive months will be transferred to the Bank of Uganda at the end of every quarter of every year.

He stated that customers could now save and invest with Xeno Investments via the mobile money platform and encouraged customers to utilize the various advance products including Momo advance, Mokash and Mosente to better their lives and those of their loved ones.

Speaking during the pay-out announcement, Mr. James Mugabi the Chairman Board of Trustees for MTN Mobile Money Uganda Limited congratulated MTN MoMo for the milestones registered since it started operations more than a decade ago and especially for contributing immensely to financial inclusion and deepening among the unbanked population.

“I am glad that the MTN MoMo has stirred the demand for various financial services and products by people who are in the lower pyramid, and thus improving their livelihoods,” he said.

“Now the interest payout on their Momo balances makes the service even more important to the population in terms of savings which is the only option to growing wealth.”

He said the pay-out will also build consumer confidence in the payment ecosystem and expand a set of mobile e-commerce capabilities to businesses and consumers as the economy becomes cashless.

FAQs about the quarter 2 Mobile/ E-money Interest, what you need to Know

- What is a Trust Account?

This is an account opened in a Bank to facilitate issuance of Mobile/electronic money and to ensure that customer funds are in safe custody. This money overtime accumulates interest from the Banks.

- Who is a customer?

A customer means anyone who uses or has used mobile money services and holds a mobile money account with funds on the MTN Mobile Money platform.

- Who is eligible to earn interest?

Mobile Money Customers who had a minimum of UGX 1 and above between 1st April and 30th June.

- How will the interest be calculated?

Interest will be calculated based on each customer’s daily average mobile money balance for three months from 1st April 2022 to 30th June 2022.

- When will the interest be paid?

The interest will be paid at the end of every quarter of every year.

- Does the interest paid include withdrawal charges?

The interest earned by each customer shall be subject to the standard withdrawal charges.

- Is the interest paid taxable?

Interest paid to each customer shall be subject to withholding tax. All customers shall be subject to withholding tax.

- How will I know that the interest has been paid?

Eligible customers will be notified through SMS alerts when the interest is paid.

- What happens if my mobile money account is dormant?

Interest accrued on dormant mobile money accounts will be paid on the customer wallet and subsequently transferred to Bank of Uganda if the account is not reactivated within the stipulated time frame.

- What is a dormant mobile money account?

As per the NPS Act, a mobile money account that has not registered a transaction for nine (9) consecutive months shall be considered dormant and it shall be closed after 6 months from the date it is considered dormant.

Feature image: Richard Yego (L) signs the dummy cheque of the total sum of money to be paid out as interest to the active MoMo customers.jpeg